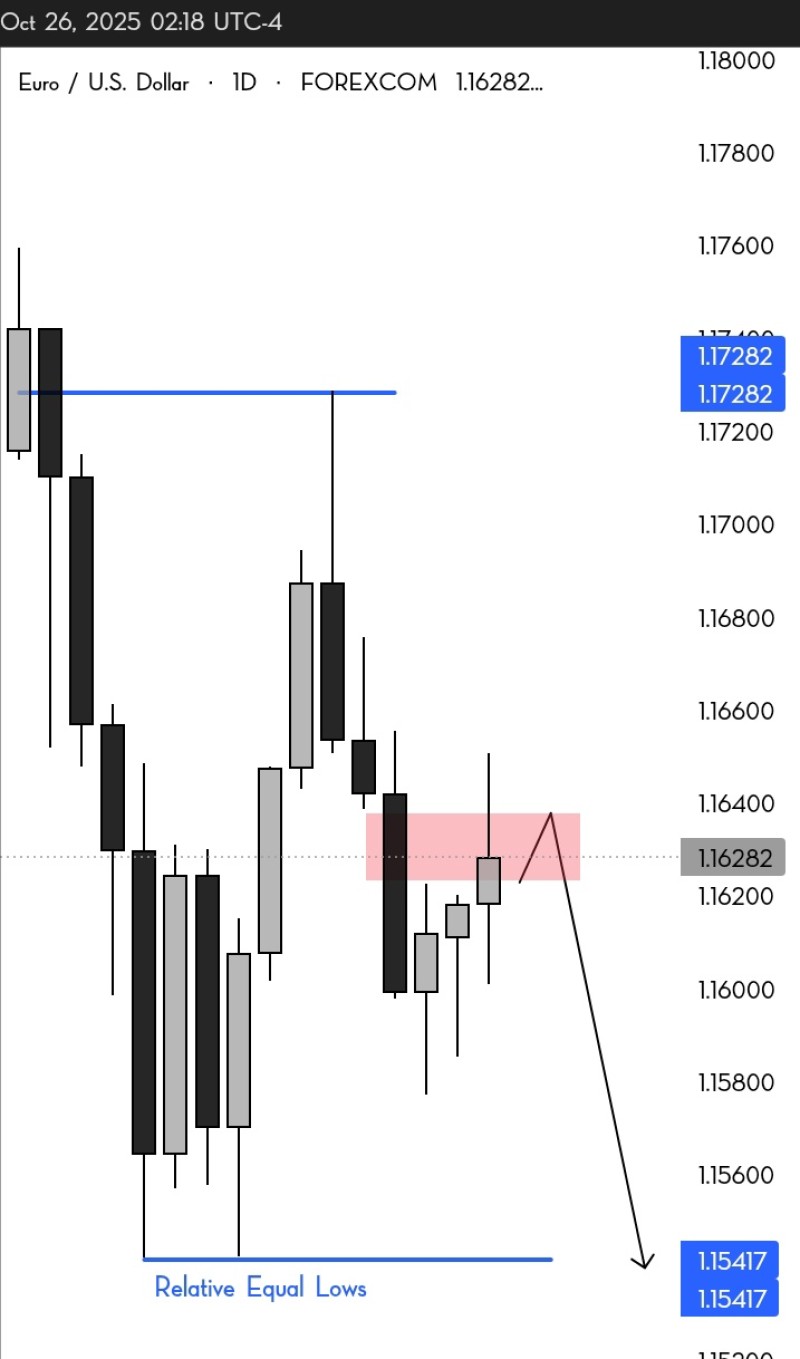

EUR/USD could be heading lower as market liquidity targets align beneath key price levels. The pair appears ready to clear Relative Equal Lows around 1.1540, signaling that bearish momentum may strengthen into next week.

Technical Analysis: Resistance Holds, Sellers Regain Control

A recent analysis from 𝐋𝐞𝐦𝐚𝐲𝐢𝐚𝐧, a forex strategist known for precision technical outlooks, reveals a clearly bearish picture on the EUR/USD daily chart. The pair continues trading below major resistance near 1.1728, where multiple failed rallies have confirmed strong supply pressure. Recent candles show repeated rejections from a minor zone around 1.1640–1.1650, marking the short-term control area for sellers.

The chart also highlights Relative Equal Lows near 1.1541, a region where liquidity is likely pooled beneath previous swing points. The forecast anticipates that the pair may revisit this area as part of a liquidity sweep before any potential reversal attempt. The projected path shows:

- A minor pullback toward 1.1640

- Followed by downward continuation toward 1.1540

- Consistent with the broader bearish structure

Market Context: Fundamentals Support the Downtrend

Fundamentals reinforce this technical setup. The U.S. dollar remains supported by resilient growth and expectations that the Federal Reserve will keep rates elevated well into 2026. Conversely, Eurozone data remains weak, with sluggish industrial activity and subdued consumer confidence limiting any hawkish shift by the European Central Bank. This divergence in monetary policy keeps EUR/USD under consistent pressure, giving bears the upper hand in the near term.

Outlook for the Week Ahead

If EUR/USD fails to reclaim 1.1650, downside continuation appears likely. A daily close below 1.1600 would confirm bearish control and open the path toward 1.1540, the liquidity target marked on the chart. However, traders should watch for temporary rallies toward resistance as potential opportunities for short positioning, especially if price revisits the highlighted zone before resuming the downward move.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi