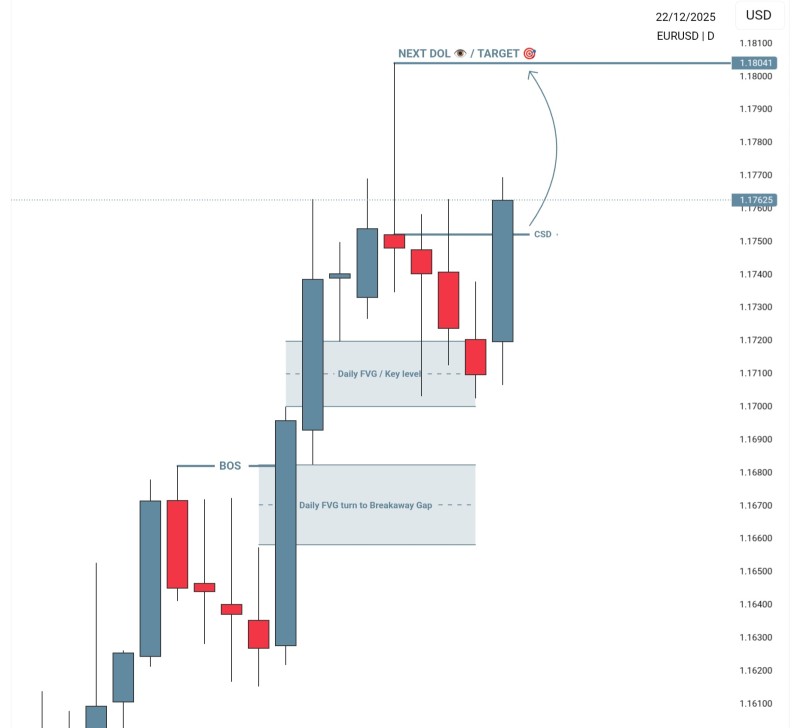

⬤ EUR/USD just delivered a powerful daily move that's got traders paying attention. Price smashed through a string of recent down days and reclaimed a critical structural zone with authority. After some consolidation around the 1.1700 level, a strong bullish candle emerged on the daily chart, suggesting the market might be ready to shift gears after its brief corrective phase.

⬤ The daily close above multiple consecutive bearish candles confirms what many were waiting for—a genuine change in market delivery. Price showed respect for the Daily Fair Value Gap and Key Level zone before surging toward the 1.1750–1.1760 region. This zone marks the Change in State of Delivery level, where buyers clearly overpowered the sellers who had been in control. The move wasn't hesitant—it was decisive.

⬤ The bullish setup was building throughout the session. EUR/USD first broke structure at lower levels, then pushed above the Daily Fair Value Gap, creating what looks like a breakaway gap. Multiple bearish candles tried and failed to drag price lower, showing that downside momentum was running out of steam. When that strong bullish candle finally appeared, it signaled renewed demand taking over from exhausted supply. This isn't just a bounce—it looks like a real structural shift.

⬤ For the broader FX market, this matters. EUR/USD is the ultimate gauge of dollar versus euro sentiment, and when it makes a move like this, traders across all major pairs take notice. If price holds above this current structure zone, the next target zone sits around 1.1800. The way daily structure, fair value gaps, and candle closes are interacting here shows how quickly short-term market bias can flip and force repositioning across the board.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova