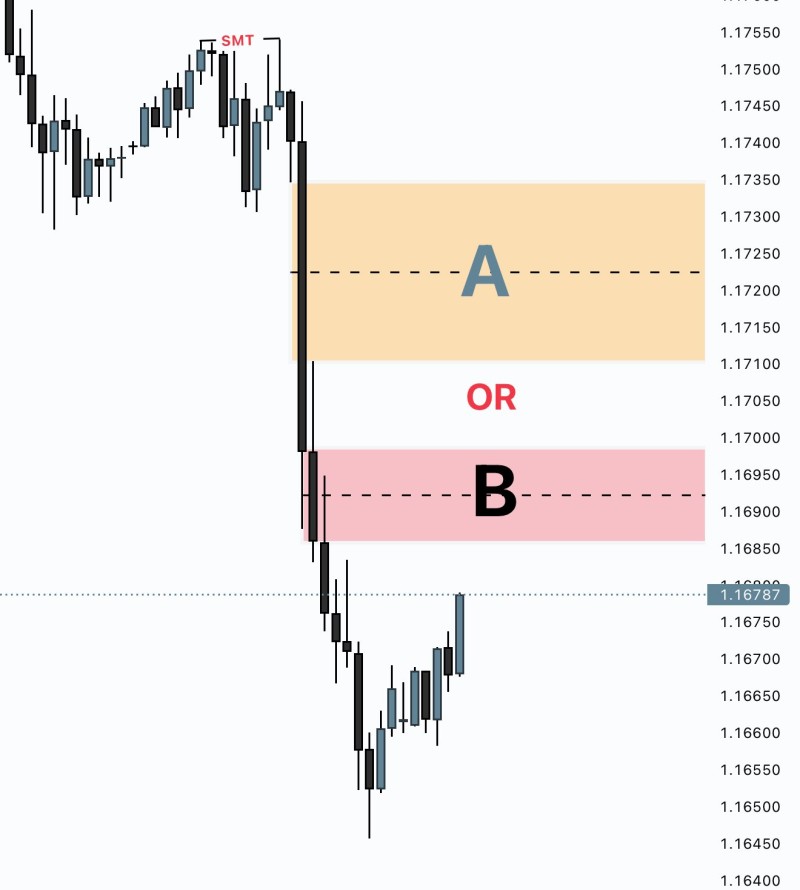

Following one of the steepest drops in recent weeks, EUR/USD is showing signs of recovery. The pair is climbing back into a critical decision zone where traders face a key question: will the euro hit resistance at the lower level or push higher to test the upper boundary? This battle between Zone A and Zone B could determine the next major market direction.

Key Resistance Levels

Two Price Delivery Arrays (PDAs) are crucial right now. Zone A sits at 1.1720–1.1735, representing a higher resistance cluster that could open doors for deeper recovery if breached.

As highlighted by Sir Hisham, this level could be key for determining the next move. Zone B ranges from 1.1690–1.1700, acting as a nearer resistance cap that might halt the rebound and trigger fresh selling pressure. With EUR/USD currently trading near 1.1678, both zones are within reach.

The dollar remains strong, supported by solid Treasury yields and hawkish Fed expectations. Meanwhile, the euro faces headwinds from weak eurozone data and ongoing growth concerns. Market sentiment stays cautious as traders wait for clear signals on whether this bounce is just a pause or marks a genuine reversal.

Trading Scenarios

The broader trend stays bearish after the recent sharp breakdown, though the rebound suggests oversold conditions are being worked off. Two main scenarios emerge: failure at Zone B would likely resume the bearish trend toward recent lows, while a break above Zone A could spark movement toward 1.1750–1.1780.

EUR/USD has reached a critical juncture. Zone B provides the first resistance test, while Zone A represents the dividing line between a minor bounce and meaningful correction. The near-term question is simple: will it be A or B?

Peter Smith

Peter Smith

Peter Smith

Peter Smith