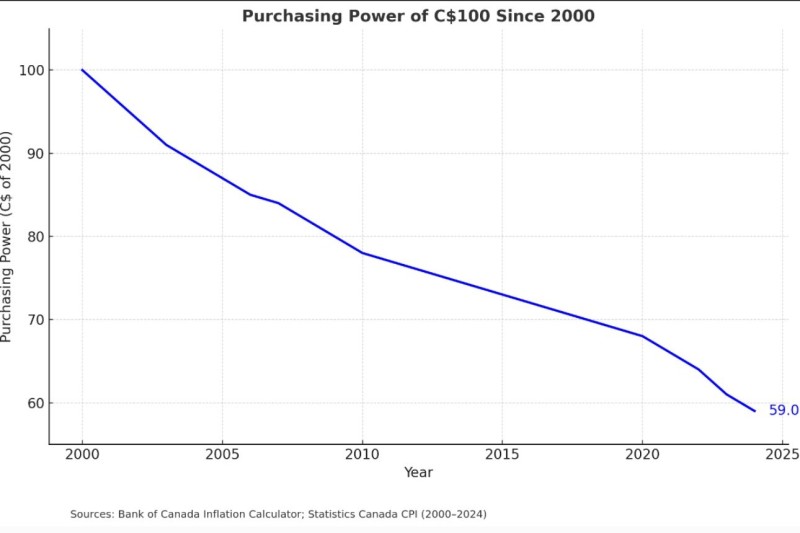

It's one of those numbers that stops you in your tracks. Take out a crisp $100 bill today, and it has the same buying power as just $59 did in the year 2000. That's not a typo—the Canadian dollar has genuinely lost 41% of its purchasing power over the past quarter-century, according to Bank of Canada data.

This isn't about dramatic market crashes or headline-grabbing currency collapses. It's about the slow, steady erosion that happens when you're not paying attention. Every grocery trip, every gas fill-up, every monthly bill represents a little more value slipping away from Canadian wallets.

The Decline of $CAD Purchasing Power

Financial analyst Ryan Williams recently put this into perspective with a chart that tells a troubling story. Since 2000, Canadian consumers have been hit with what essentially amounts to a hidden tax—one that doesn't show up on any government receipt but quietly drains bank accounts year after year.

Think about it: if you had $10,000 saved in 2000 and just let it sit in a regular savings account, you'd need $16,949 today to have the same buying power. That's a massive wealth transfer that happened without most people even noticing.

Inflation's Long-Term Toll on $CAD Price

The decline hasn't been dramatic—it's been relentless. Every economic shock seems to accelerate the process. The 2008 financial crisis, the pandemic spending spree, and the recent energy price surge have all taken their toll.

Sure, the Bank of Canada talks about targeting 2% inflation, but real life doesn't care about targets. Housing costs have exploded, food prices keep climbing, and energy bills seem to only go in one direction. Meanwhile, that $100 bill in your wallet quietly loses a little more of its punch each year.

Why the Falling $CAD Price Matters for Households and Investors

Here's where it gets personal. That morning coffee that used to cost $1.50? Now it's $3.50. The house your parents bought for $200,000? Good luck finding anything decent for less than $500,000. And your savings account? It's working overtime just to tread water.

Smart Canadians figured this out years ago. They moved money into real estate, stocks, and yes, even cryptocurrency. Bitcoin and Ethereum have become the new hedge against a currency that just can't seem to hold its value. Those who stuck with cash-only strategies are learning an expensive lesson about inflation.

Can $CAD Price Stability Be Restored?

The million-dollar question—or should we say the $590,000 question in today's dollars—is whether anything can be done. The Bank of Canada keeps tweaking interest rates like they're fine-tuning a race car, but the structural problems run deeper.

We're dealing with massive government debt, volatile energy markets, and trade imbalances that make the loonie look more like a sitting duck than a stable currency. Without serious policy changes, that $100 bill might be worth even less by 2030.

For everyday Canadians, the message is clear: your money is quietly disappearing, and hoping things will magically get better probably isn't a strategy.

Peter Smith

Peter Smith

Peter Smith

Peter Smith