XRP (Ripple) faced intense selling pressure as whale wallets dumped more than 2.23 billion tokens in just a few days, raising concerns about short-term stability. Large investors - known as whales - play a decisive role in shaping crypto market dynamics. When billions of tokens move within days, it often signals a turning point. The latest XRP whale activity, showing one of the largest sell-offs this year, has shaken sentiment and forced traders to closely watch key support levels.

Whale Activity Triggers Sharp Decline

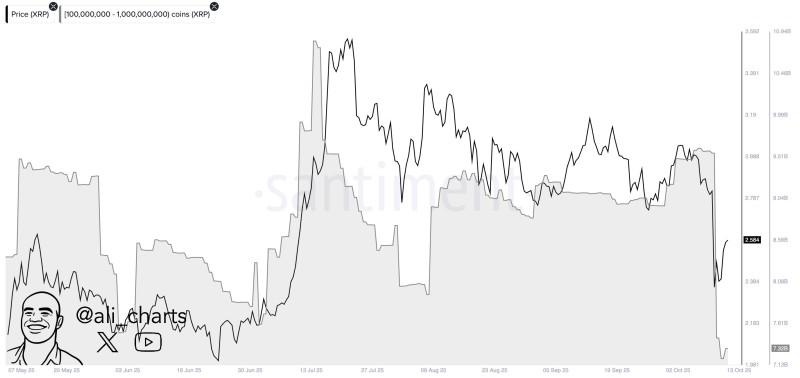

According to analyst Ali, wallets holding between 100 million and 1 billion XRP coins liquidated 2.23 billion XRP since Friday.

On-chain data clearly shows this steep reduction, with whale balances falling from over 9.5 billion XRP to around 7.3 billion XRP in less than a week. This mass distribution triggered strong selling pressure, pushing XRP's price down to around $2.58. The market reaction highlights the significant correlation between whale moves and short-term price direction.

The chart illustrates a clear pattern: whale holdings collapsed sharply, matching XRP's drop from near $2.90 toward $2.50. Buyers previously defended the $2.30–$2.40 range, making it a crucial level to watch, while the $2.90–$3.00 area remains the major hurdle for any bullish recovery. If selling pressure eases, XRP could stabilize near support before attempting to reclaim higher ground.

The chart illustrates a clear pattern:

- Supply Shock: Whale holdings collapsed sharply, matching XRP's drop from near $2.90 toward $2.50.

- Support Zone: Buyers previously defended the $2.30–$2.40 range, making it a crucial level to watch.

- Resistance Zone: The $2.90–$3.00 area remains the major hurdle for any bullish recovery.

If selling pressure eases, XRP could stabilize near support before attempting to reclaim higher ground.

Understanding the Sell-Off

Several factors could explain the massive liquidation. Profit-taking following recent rallies may have prompted whales to cash in on accumulated gains. Broader crypto weakness, macroeconomic concerns, and regulatory debates may have triggered risk-off moves among large holders. Additionally, whales could be reallocating capital into other assets as part of portfolio rebalancing strategies.

What's Next for XRP

The 2.23 billion XRP whale dump shows just how quickly market conditions can shift. While the immediate effect has been negative, such sell-offs can create new opportunities for accumulation if demand returns at lower levels. For now, all eyes remain on whether XRP can hold the $2.30–$2.40 floor. Sustaining this zone may set the stage for another attempt toward $3.00, while further whale exits could drag the token into deeper correction.

Usman Salis

Usman Salis

Usman Salis

Usman Salis