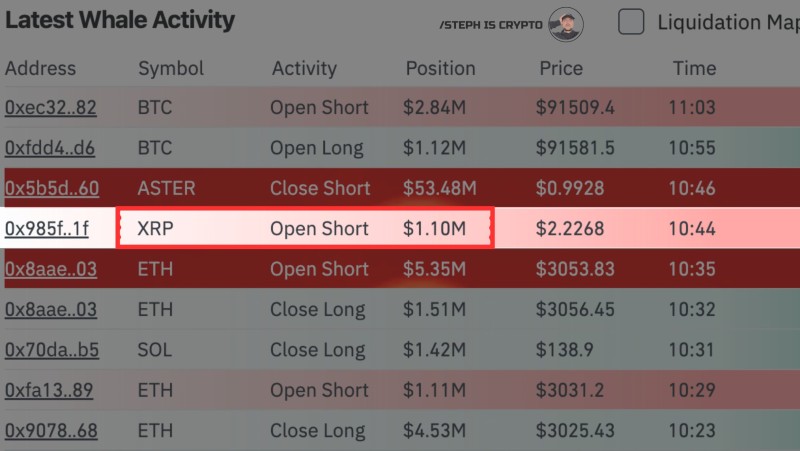

⬤ A big player in the XRP market just made a bold move by opening a $1.10 million short position. On-chain data shows a whale wallet entered the short at $2.2268, with the transaction timestamped at 10:44. The trade appeared prominently in recent whale activity feeds, confirming the position's entry point and size.

⬤ The whale tracking panel reveals a flurry of large positions across multiple tokens, with XRP joining other major assets like BTC, ETH, SOL and ASTER. What makes this XRP short notable is its timing—it comes during a period of mixed sentiment and price swings. The $1.10 million bet against XRP reflects growing downside positioning among heavyweights, and the precision of the $2.2268 entry shows this wasn't a casual trade.

⬤ The data suggests big traders are getting more cautious. The mix of short and long orders across different assets indicates the market is bracing for increased volatility. XRP's recent price action has attracted aggressive leveraged bets, and whale movements like this often signal shifting short-term momentum. While we don't know exactly why this whale went short, the trade size fits the current pattern of bearish positioning on major exchanges.

⬤ Large short positions matter because they can shake up market structure by affecting liquidity, driving volatility and influencing sentiment. XRP is trading in a delicate zone right now, and when whales place million-dollar bets, it adds another layer of uncertainty. Whether this signals a bigger downward move or just one trader's play, the size of the position highlights how unpredictable XRP's near-term direction remains.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah