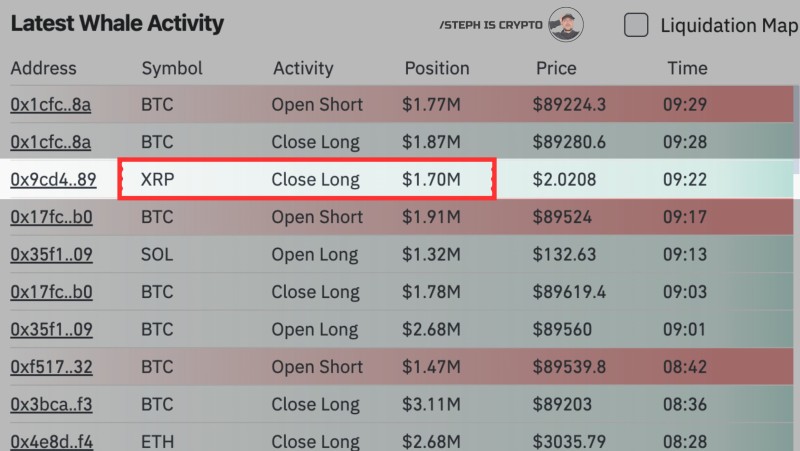

⬤ A significant move hit the XRP market when a large holder closed a $1.70 million long position at $2.02. The trade showed up in the latest whale activity feed alongside several sizable BTC, SOL, and ETH transactions. The XRP entry caught attention due to its size, standing out as one of the largest single XRP actions on the list and prompting speculation about whether positioning or sentiment might be shifting.

⬤ The whale feed data shows the XRP long position was closed at 09:22, with the system marking the position value at $1.70 million and execution price at $2.0208. Other large entries around the same time included BTC open shorts and long closures, but the XRP transaction was the only one representing a multi-million dollar adjustment for that asset. XRP price action frequently reacts to whale-level movements, and a closure of this scale often raises questions about liquidity conditions or perceived short-term risk, though the data doesn't clarify the whale's motivation.

⬤ The broader whale transaction list reflects mixed positioning across major cryptocurrencies, with alternating long closures and short openings across BTC, SOL, and ETH. This suggests an environment where high-volume traders are actively adjusting exposure as market volatility remains elevated. The XRP long closure at $2.02 appears alongside several Bitcoin position adjustments, indicating that major participants are recalibrating risk across multiple assets.

⬤ Large position closures like this carry weight because whale transactions can influence expectations around stability, trend continuation, or potential corrections. When a multi-million dollar long gets closed around a key price level, it can heighten market sensitivity and shift sentiment. With XRP trading near the $2 region, moves of this nature may affect short-term confidence and shape how traders gauge upcoming volatility.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov