After nearly five years of courtroom drama, the U.S. Securities and Exchange Commission has finally called it quits on its enforcement case against Ripple Labs. This isn't just another regulatory update – it's the end of a legal saga that's been hanging over XRP like a storm cloud since December 2020.

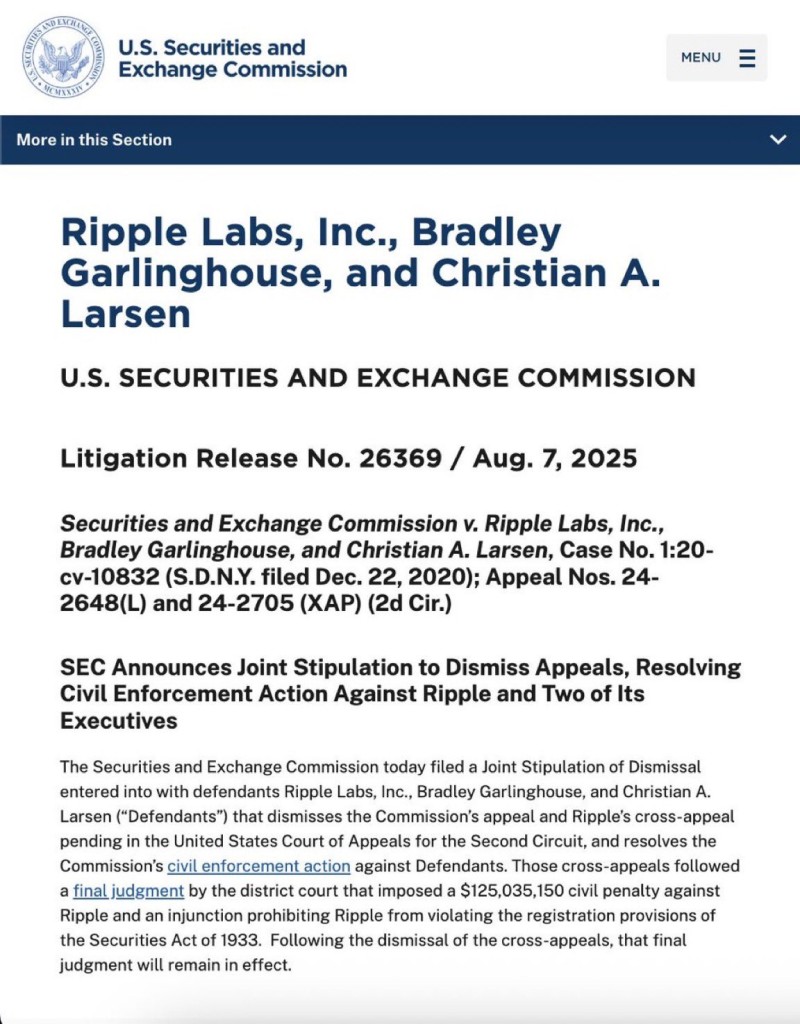

The whole thing wrapped up on August 7, 2025, when the SEC filed papers to dismiss both their appeal and Ripple's counter-appeal. What started as an aggressive attempt to label XRP as an unregistered security has ended with Ripple paying a $125 million fine and walking away mostly intact.

XRP Price Gets Fresh Wind in Its Sails

Now that the legal nightmare is over, XRP holders are feeling pretty optimistic about what comes next. The lawsuit wasn't just a headache for Ripple's lawyers – it actually scared off exchanges and institutional investors who didn't want to touch anything the SEC might consider a security.

With that cloud lifted, we're likely to see exchanges that delisted XRP start bringing it back. More importantly, institutional money that's been sitting on the sidelines might finally feel comfortable diving in. The market's already buzzing about potential partnerships and adoption deals that were probably on ice during the legal fight.

Why This Changes Everything for XRP

This wasn't just any old regulatory spat. The Ripple case became the poster child for how messy crypto regulation can get in the U.S. Everyone from Bitcoin maximalists to DeFi developers was watching to see how it would play out, knowing it could set precedents for the entire industry.

The fact that it ended with a settlement rather than a crushing defeat for Ripple sends a pretty clear message: the SEC isn't interested in burning down the crypto industry, they just want companies to play by certain rules. For XRP specifically, this means the token can finally operate without that "potential security" stigma weighing it down.

Sure, Ripple had to cough up $125 million, but that's pocket change compared to what they could have faced if things went south. More importantly, they get to keep doing business as usual, just with some extra compliance requirements going forward.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah