XRP (Ripple) continues trading near $3.50 as massive short positions build up, while experts remain bullish on ETF approval hopes and technical breakout signals.

XRP is holding its ground above the key $3.35 support level after hitting its all-time high recently. The token is currently trading around $3.50, up a modest 0.35% in the last 24 hours, even as traders have piled into nearly $260 million worth of short positions at the $3.68 level.

Trading activity has picked up significantly, with volume jumping 16% as both short-term traders and long-term investors position themselves differently in the market. This increased interest comes at a time when XRP faces mixed signals from various market participants.

XRP (Ripple)Traders Split on Price Direction

The data tells an interesting story about how different types of investors are approaching XRP right now. According to CoinGlass, long-term holders are quietly accumulating more tokens, showing they're confident about the future despite current uncertainty. Meanwhile, short-term traders seem to be betting on a price drop.

What's really catching attention is that $56.85 million worth of XRP left exchanges in just 48 hours. When investors move their coins off exchanges into private wallets, it usually means they're planning to hold for the long haul rather than trade actively.

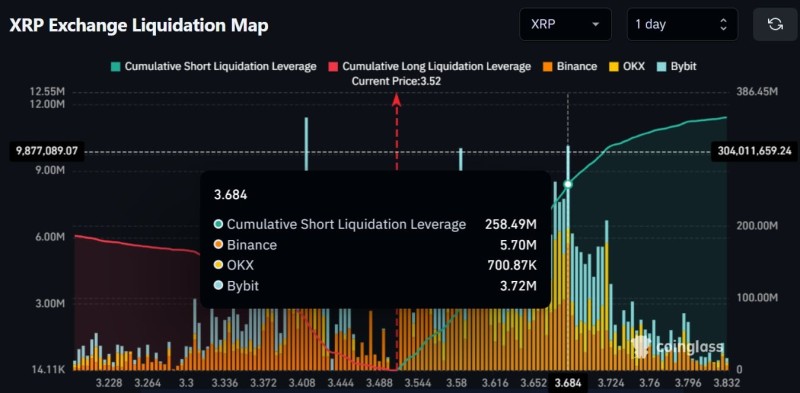

But the trading picture looks different. Bears have built up $258 million in short positions at $3.684, while bulls are sitting on $69.51 million in long positions at $3.412. These massive position sizes show just how divided the market is right now about where XRP goes next.

Experts Stay Bullish Despite Short Interest

Even with all this mixed sentiment, crypto experts are staying optimistic about XRP's prospects. That huge pile of short positions has actually got some analysts excited, thinking these bears might get squeezed if the price moves up unexpectedly.

The big news came on July 22nd when a well-known crypto expert posted on X that the chances of a Spot XRP ETF getting approved had jumped to 95%. If that happens, it could be a game-changer for XRP, bringing in institutional money and potentially driving prices much higher.

Another expert made waves by predicting XRP could hit $15, pointing to the weekly chart where XRP has broken out of what looks like a bullish flag pattern. That's pretty ambitious though - it would mean XRP needs to climb about 327% from where it is now.

XRP Price Faces Key Technical Test

From a technical standpoint, XRP is still in an uptrend, and the fact that it's holding above its breakout level is encouraging for bulls. If it can defend current support, the next target based on Fibonacci levels could be around $6.

However, there's one warning sign that traders should watch. XRP's RSI is sitting at 83, which puts it deep in overbought territory. This suggests we might see a short-term pullback before any major rally continues. If support fails, the price could drop back to around $3.40.

The bottom line is that XRP is at a critical juncture. With massive short positions built up and experts turning more bullish on ETF approval odds, the next move could be significant in either direction. Those short positions could either pay off big if XRP drops, or create a painful squeeze if the bulls regain control.

Peter Smith

Peter Smith

Peter Smith

Peter Smith