XRP fell 15% this week after Ripple co-founder Chris Larsen moved $175 million in tokens to exchanges, right as the crypto hit its all-time high.

Talk about bad timing. Just as XRP was celebrating its new all-time high of $3.65 on July 18th, Ripple co-founder Chris Larsen decided to move a massive chunk of his tokens. We're talking $175 million worth of XRP here – not exactly a small sale.

Crypto sleuth ZachXBT caught Larsen red-handed, showing that an address linked to him had transferred out 50 million XRP since July 17th. The tokens went to three exchange wallets and two fresh addresses. When you see moves like that right at the peak, you know what's coming next.

XRP had just pushed its market cap to $215.2 billion with that $3.65 high, but instead of riding the wave, investors watched nervously as Larsen shipped $30 million worth of XRP straight to Coinbase. The message was pretty clear – time to cash out.

The broader crypto market correction didn't help either. XRP got knocked back 15% from its weekly high, and suddenly everyone remembered why co-founder selling at the top is never good news.

XRP (Ripple) Traders Get Wrecked by Liquidations

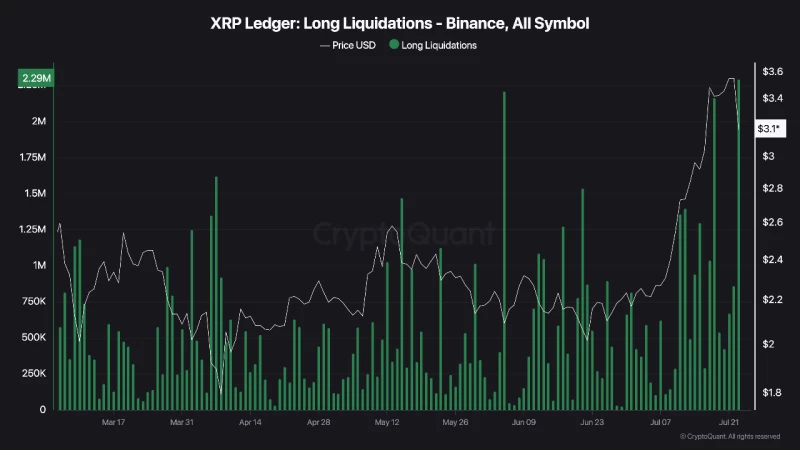

Things got nasty fast when the selling pressure hit leveraged traders. On July 23rd, XRP dropped 10.3% in a single day, and that's when the real pain started. According to CryptoQuant analyst Darkfost, long liquidations on Binance were absolutely brutal.

Nearly $7.3 million in long positions got wiped out as traders who'd gotten too greedy with leverage paid the price. CoinGlass data showed the carnage continued with $25.33 million worth of positions liquidated in just 24 hours – and $16.42 million of those were longs.

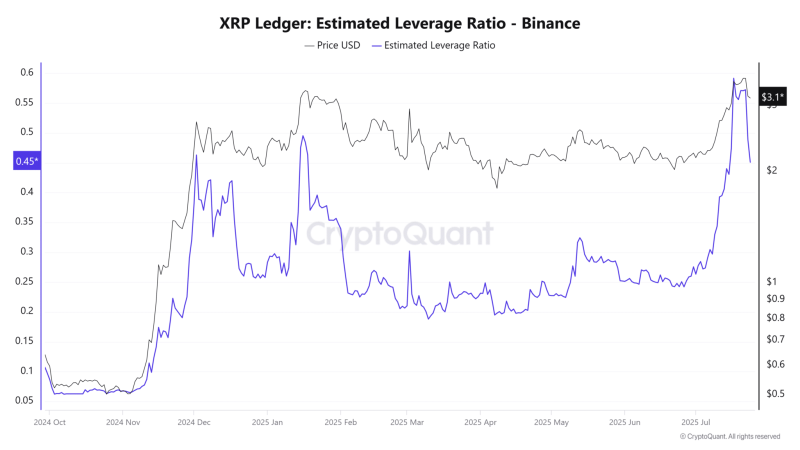

It's the same old story in crypto. Prices moon, everyone goes crazy with leverage, then reality hits and the liquidation cascade begins. The leverage ratio had shot up big time during July's rally, so this correction was basically inevitable.

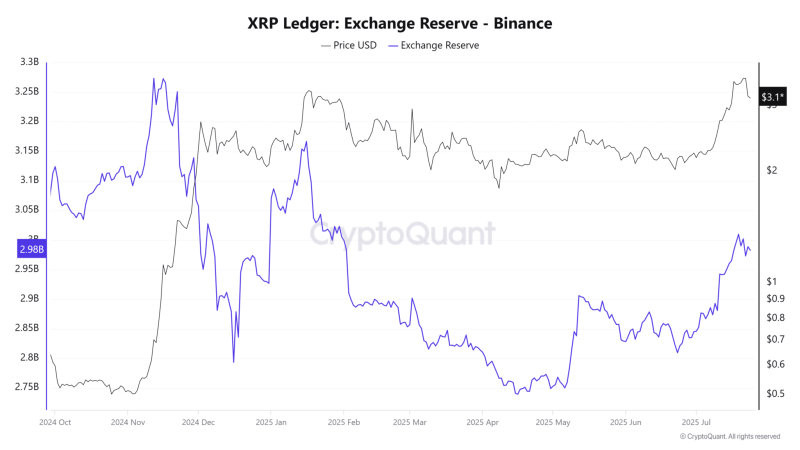

What made it worse? Exchange reserves had been climbing since May, going from 2.75 billion XRP on May 6th to 2.98 billion on July 24th. Rising exchange reserves usually mean people are getting ready to sell, and this time was no different.

XRP (Ripple) Price Holds Key Support Zone

Here's the good news though – XRP isn't completely falling apart. The $2.9 to $3 area is acting like a solid support zone, and it's holding up pretty well so far. This level has been important for traders, and it's doing its job as psychological support.

Sure, Larsen's selling and the market-wide correction put pressure on XRP short-term, but that doesn't mean the bull run is over. Sometimes you need these shakeouts to get rid of weak hands and reset before the next move up.

Right now, it looks like XRP might chill around $3 for a bit while things cool down. That would give both derivatives traders and regular buyers time to figure out what's next. All that leverage from July needed to get flushed out anyway.

The big question is whether this is just a normal pullback or something more serious. With the $2.9-$3 support holding and most of the liquidations probably done, XRP could be setting up for another leg higher once the dust settles. But first, it needs to prove this support zone can actually hold when tested.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah