XRP traders are loading up on short positions while open interest peaked at $3.9 billion, setting up a potential major move above or below $3.2.

XRP is stuck in no man's land right now, and it's making everyone nervous. After getting knocked back from $3.50, the token has been bouncing between $3.00 and $3.20 for four straight days. But don't let that boring price action fool you – there's some crazy stuff happening underneath that could send XRP flying in either direction.

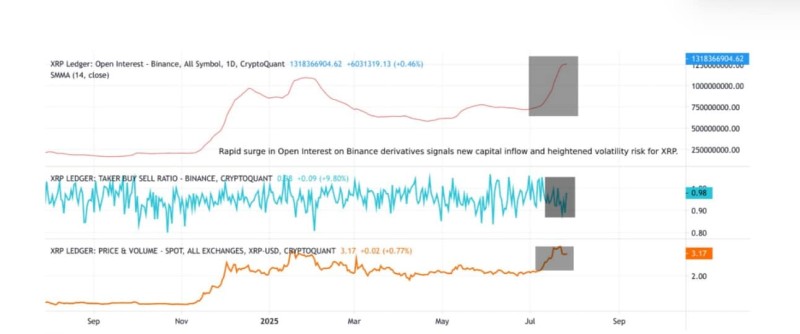

The big story here is what's going on in the derivatives market. Open interest on Binance's XRP futures hit a massive $3.9 billion earlier this week before dropping to $3.08 billion. That's a ton of money betting on XRP's next move, and when you see numbers like that, you know something big is brewing.

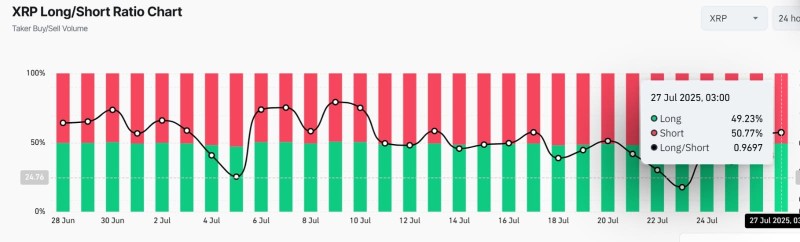

Here's the weird part though – most of these new bets aren't bullish. CoinGlass data shows more traders are going short than long, with shorts making up 50.77% of all XRP futures compared to 49.23% for longs. The Long/Short Ratio is sitting at 0.96, which means people are basically expecting XRP to crash.

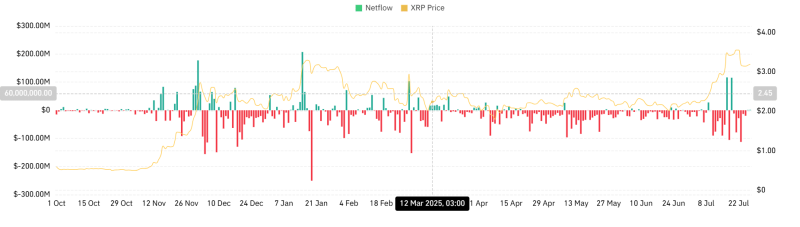

On top of that, exchange netflows have been positive for two days straight, hitting $1.28 million. That means more XRP is flowing into exchanges, usually a sign that people want to sell.

XRP (Ripple) Price Setting Up for Short Squeeze or Crash

This whole situation is setting up for either a brutal short squeeze or a nasty drop. When open interest spikes while prices move sideways, it usually means the market is loading up for a big breakout. The question is which way it goes.

All those short positions could backfire spectacularly if XRP starts moving up even a little bit. When everyone's betting against something and it starts rising, panic buying kicks in fast. If money keeps flowing into the market, XRP will likely punch through $3.2 and head back toward $3.5, which would absolutely wreck all those short positions.

But there's a flip side. If selling pressure keeps building and profit-takers keep dumping their bags, those long positions are toast. In that case, XRP would probably slide down to $2.90, giving the bears exactly what they want.

XRP (Ripple) Price: $3.2 is Make or Break

According to AMBCrypto's analysis, XRP is basically trapped while shorts absorb selling pressure from people taking profits. But here's the thing – markets love to bait traders before doing the opposite of what everyone expects.

The key level everyone's watching is $3.2. Break above it with all this short interest, and we could see a violent squeeze that sends XRP rocketing higher. Break below it, and those shorts might actually be right, with $2.90 looking like the next stop.

With nearly $4 billion in open interest that's already started dropping and exchange inflows showing selling pressure, XRP's next move definitely won't be small. There's way too much leveraged money on both sides for this to end quietly. Someone's about to get burned – the only question is whether it'll be the bulls or the bears.

Peter Smith

Peter Smith

Peter Smith

Peter Smith