XRP (Ripple) took a major blow after BlackRock confirmed they won't launch an XRP ETF despite recent regulatory wins, potentially damaging future price prospects.

Talk about bad timing. Just when XRP (Ripple) holders thought they had it made after beating the SEC, BlackRock basically said "not interested" to an XRP ETF. The world's biggest asset manager made it clear they have zero plans for XRP products.

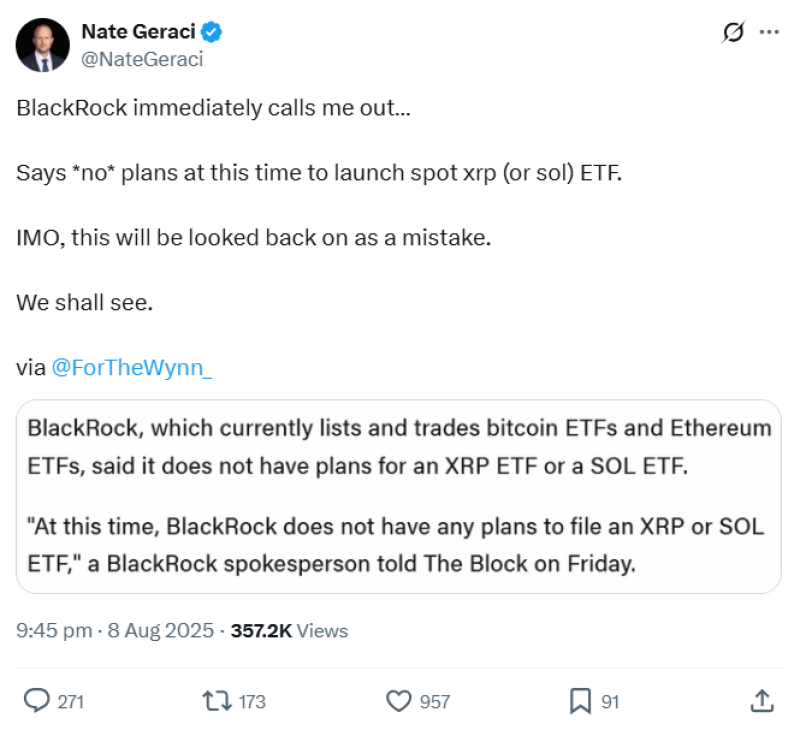

This bombshell dropped right after ETF Store President Nate Geraci suggested BlackRock might jump into the XRP (Ripple) game. He thought they were waiting for Ripple's legal mess to end before filing. Turns out he was dead wrong.

Here's what stings: XRP (Ripple) finally got regulatory clarity after years of legal hell, and now the biggest institutional gatekeeper is giving them the cold shoulder.

XRP Price Outlook Gets Reality Check

BlackRock's rejection isn't just hurt feelings – it's a massive roadblock for XRP's Wall Street dreams. When a $10 trillion asset manager says "no thanks," that sends shockwaves through institutions.

BlackRock executives have been blunt about sticking with Bitcoin and Ethereum only. Robert Mitchnick said there's "very little" demand for other crypto ETFs. Jay Jacobs confirmed no new altcoin ETFs are planned.

The numbers tell the story. BlackRock's Bitcoin and Ethereum ETFs pulled in billions. As Samara Cohen told Bloomberg – only Bitcoin and Ether meet their standards for "investing ability considerations and client considerations."

This creates a catch-22 for XRP. No institutional products means less demand, which means less reason to create those products. It's keeping XRP stuck in altcoin territory.

XRP (Ripple) Price Prediction: What's Next?

BlackRock's "no" removes a huge catalyst many were counting on. ETF approvals usually trigger massive rallies – just look at Bitcoin and Ethereum's runs.

Other asset managers could still file for XRP ETFs now that regulatory fog cleared. Problem is, BlackRock sets the tone in ETF land.

ETF expert Eric Balchunas backs BlackRock's play. He doesn't expect any index-based crypto ETF including XRP this year, citing diminishing returns.

The irony? Regulatory approval was supposed to be XRP's golden ticket. Instead, we're learning beating the SEC is just step one. Market demand and institutional interest matter just as much.

For now, XRP holders will have to look elsewhere for their next big catalyst.

Usman Salis

Usman Salis

Usman Salis

Usman Salis