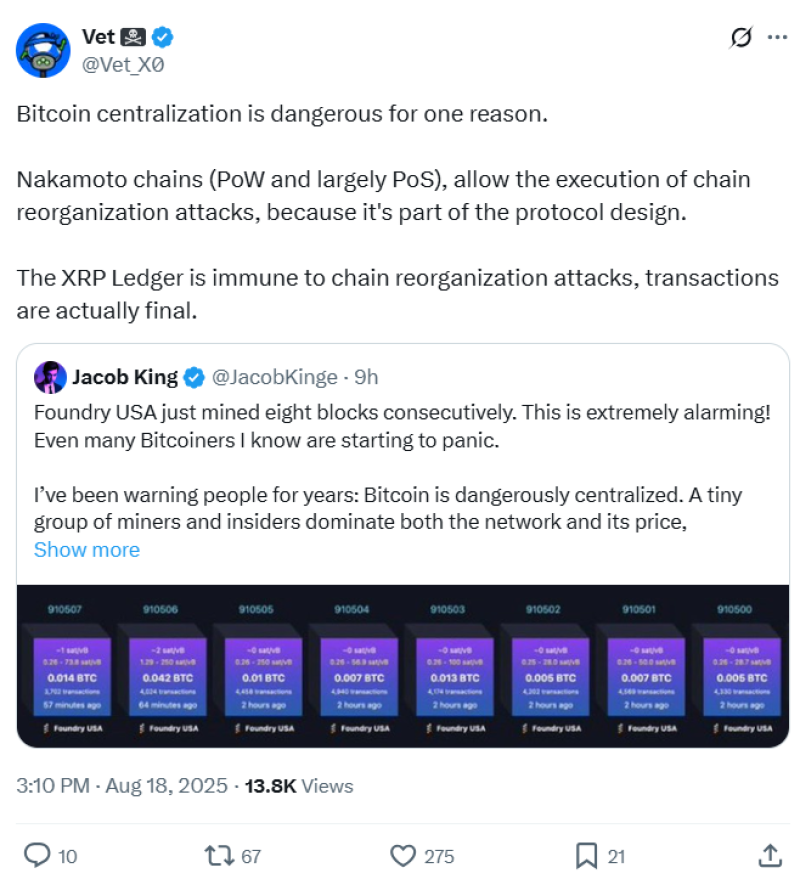

Bitcoin just had one of those moments that makes everyone uncomfortable. Foundry USA mining pool cranked out eight blocks in a row, and suddenly the crypto world is having that awkward conversation about centralization again. But this time, XRP advocates aren't staying quiet.

XRP Validator Exposes Bitcoin's Fatal Flaw

Vet, who runs an XRPL validator and co-founded xrpcafe, didn't mince words about what he saw. "Dangerously centralized," he called it, pointing out something that Bitcoin maximalists hate to admit: the whole system can be rewound if the wrong people get too much control.

Here's the thing that's got Vet fired up - Bitcoin's design actually allows for chain reorganizations. That means if miners gang up or one pool gets too powerful, they can literally rewrite history and reverse transactions that people thought were final. It's built into the system, whether we're talking proof-of-work or proof-of-stake networks.

Those eight blocks from Foundry USA? They're not going to break Bitcoin tomorrow. But they're a perfect example of how quickly things can get sketchy when mining power concentrates in one place. And honestly, it happens more often than people like to talk about.

Why XRP (Ripple) Claims It's Different

This is where Vet gets really passionate about XRP Ledger's approach. Once your transaction goes through on XRPL, it's done. Final. No takebacks, no rewinding, no "oops, let's try that again." It's a completely different philosophy from Bitcoin's "probably final after six confirmations" approach.

For developers building real applications - think games where people trade valuable NFTs, or payment systems where money needs to move fast - this kind of certainty isn't just nice to have, it's everything. You can't build reliable apps on top of a system where confirmed transactions might get undone later.

Bitcoin fans will argue that their probabilistic finality works fine if you just wait long enough. But XRP supporters counter that "wait and hope" isn't really a solution when you need absolute certainty right now.

XRP vs Bitcoin: The Battle for 2025

The numbers tell an interesting story. Bitcoin still dominates with about 59% of the crypto market, but every time something like this Foundry USA situation happens, XRP advocates get louder about their "different, not just cheaper" message.

They're not just talking about faster transactions or lower fees anymore. The pitch is about fundamental reliability - "finality you cannot rewind, assets that don't vanish behind someone's API," as the XRPL community puts it.

Whether that message resonates depends on how much people care about these technical differences. But with events like the eight-block streak keeping the centralization debate alive, don't expect this conversation to die down anytime soon. If anything, it's just getting started.

Usman Salis

Usman Salis

Usman Salis

Usman Salis