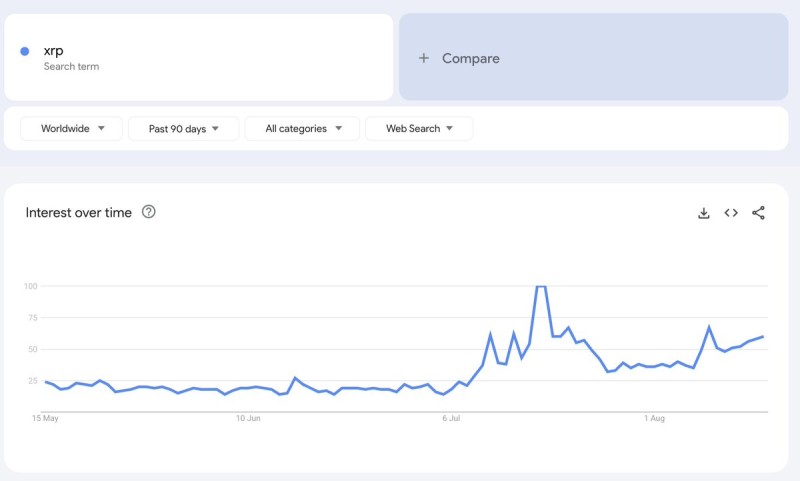

Google Trends reveals a fascinating story unfolding around XRP that most traders are missing. Search volume for the cryptocurrency has jumped dramatically over the past 90 days, climbing steadily since early July before hitting peak levels mid-month. What makes this interesting isn't just the numbers—it's the timing and what it typically means for price action.

This pattern of rising curiosity without corresponding retail buying often marks the calm before significant market moves. While searches spike and volume creeps higher, the majority of everyday investors are still scrolling past XRP without taking action.

XRP Price Signals: The Quiet Accumulation Phase

A recent social media post captured this dynamic perfectly, noting how "retail's still asleep" despite clear momentum building beneath the surface. The message highlighted a crucial market psychology principle: major moves often begin when interest grows but before mainstream participation kicks in.

The data shows XRP sitting in what technical analysts call an accumulation zone. Search trends are climbing, trading volume is gradually increasing, and early positioning is happening—but without the fanfare that usually accompanies retail FOMO (fear of missing out).

What This Means for XRP Price Action

History suggests these quiet momentum phases don't last forever. When retail eventually wakes up to what the data is already showing, the resulting price action can be swift and substantial. The gap between growing interest and actual market participation creates a spring-loaded effect.

For now, XRP remains in this pre-breakout state where the foundation is being built for potential larger moves. Whether that translates to significant price appreciation depends on how quickly retail sentiment shifts and whether current trends continue building momentum.

The next few weeks could prove telling for XRP price direction as these underlying signals either develop into broader market participation or fade back into quiet accumulation.

Peter Smith

Peter Smith

Peter Smith

Peter Smith