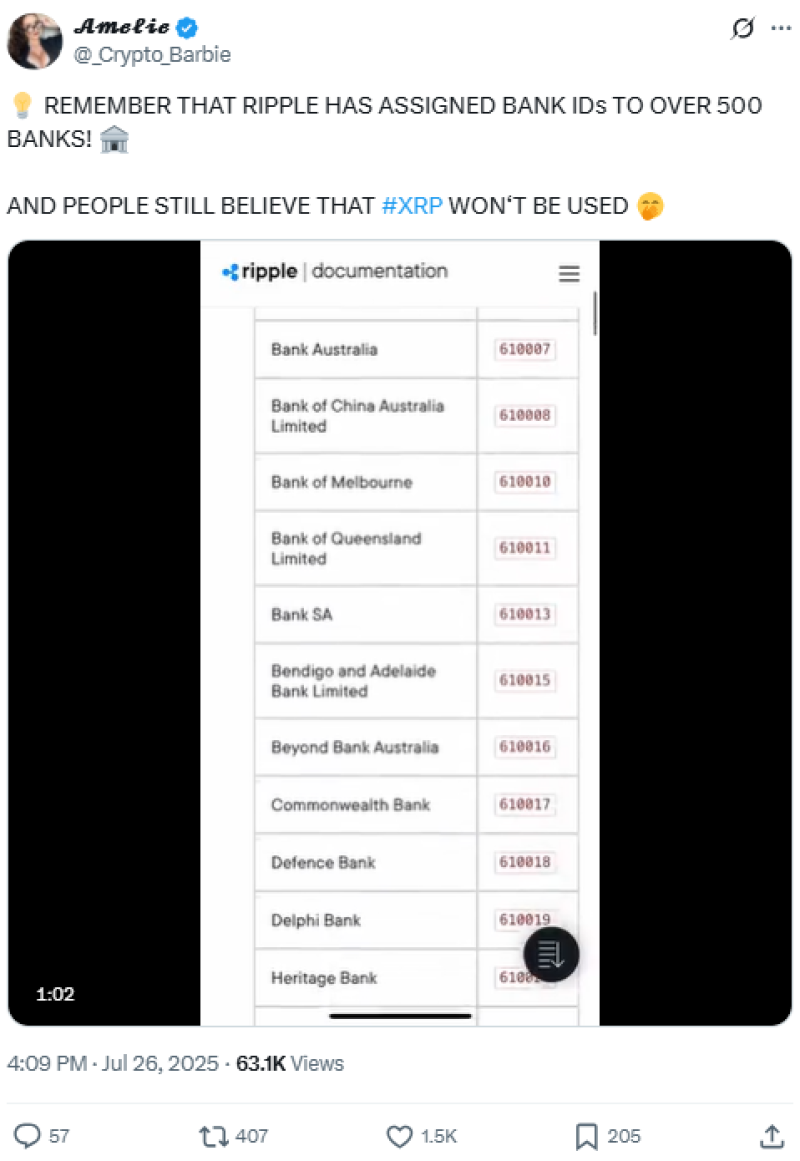

Ripple’s massive expansion in the banking sector is shaping the narrative around XRP price potential. With over 500 banks now assigned unique Ripple IDs, the platform’s credibility as a global payments solution continues to grow, highlighting XRP’s role as a bridge currency.

Ripple’s Global Banking Reach

Ripple’s partnerships with more than 500 financial institutions worldwide strengthen its infrastructure for fast and cost-effective cross-border payments. This wide adoption of RippleNet increases the practical use cases for XRP, potentially influencing its price trajectory in the mid to long term.

XRP Price Outlook and Market Sentiment

Investors and traders are closely watching XRP price movements, fueled by Ripple’s technological advancements and institutional adoption. As the global financial system shifts toward digital assets, XRP’s growing utility could support bullish price momentum.

Ripple’s partnership with over 500 banks underscores its expanding influence in traditional finance. This wide-scale adoption could act as a key driver for XRP price growth, making it a cryptocurrency to watch in the coming years.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah