XRP (Ripple) could be hours away from complete regulatory freedom as the SEC-Ripple settlement awaits final court approval. After nearly five years of legal drama, institutional investors might finally get the green light.

XRP Settlement Update: Both Sides Call It Quits

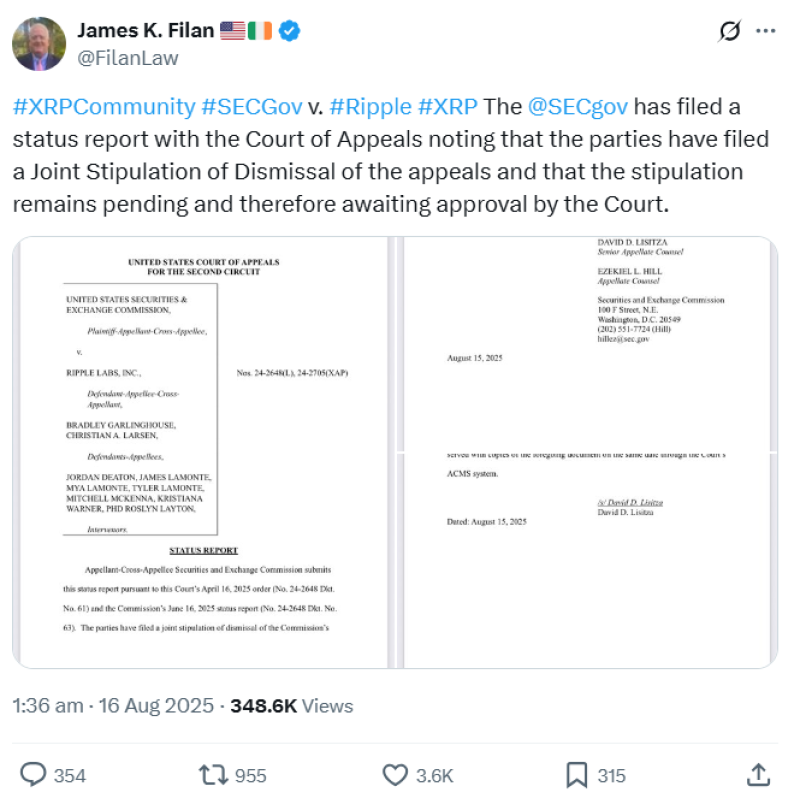

On August 15, the SEC filed a status report telling the Court of Appeals that both parties are dropping their appeals and covering their own legal bills. After almost five years of courtroom drama, they're finally calling it quits.

Pro-XRP lawyer Bill Morgan says Judge Torres could drop the final hammer any day now, officially ending this mess. When that happens, things could get really interesting for XRP holders who've been waiting on the sidelines.

XRP (Ripple) From $1.3B Nightmare to $125M Settlement

Rewind to December 2020: the SEC claimed Ripple illegally raised $1.3 billion by selling XRP without registering it as a security. XRP's price tanked, and everyone panicked.

Then came the July 2023 plot twist. Judge Analisa Torres said XRP sales to regular folks weren't securities, but institutional sales were. The result? Ripple paid $125 million to the SEC – way less than originally demanded. Most XRP supporters called this a massive win.

XRP What's Next: Institutions Ready to Jump In

This isn't just about closing a legal case – it could reshape crypto in America. Banks, big investors, and ETF providers have been waiting for regulatory clarity, and XRP has already started making institutional moves.

Once the Court of Appeals gives the final nod (which looks like a formality), XRP could see institutional flood gates open. The settlement can't officially kick in until then, but with both sides agreeing to walk away, approval seems guaranteed.

For XRP holders who've been on this five-year rollercoaster, the exit ramp is finally in sight.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah