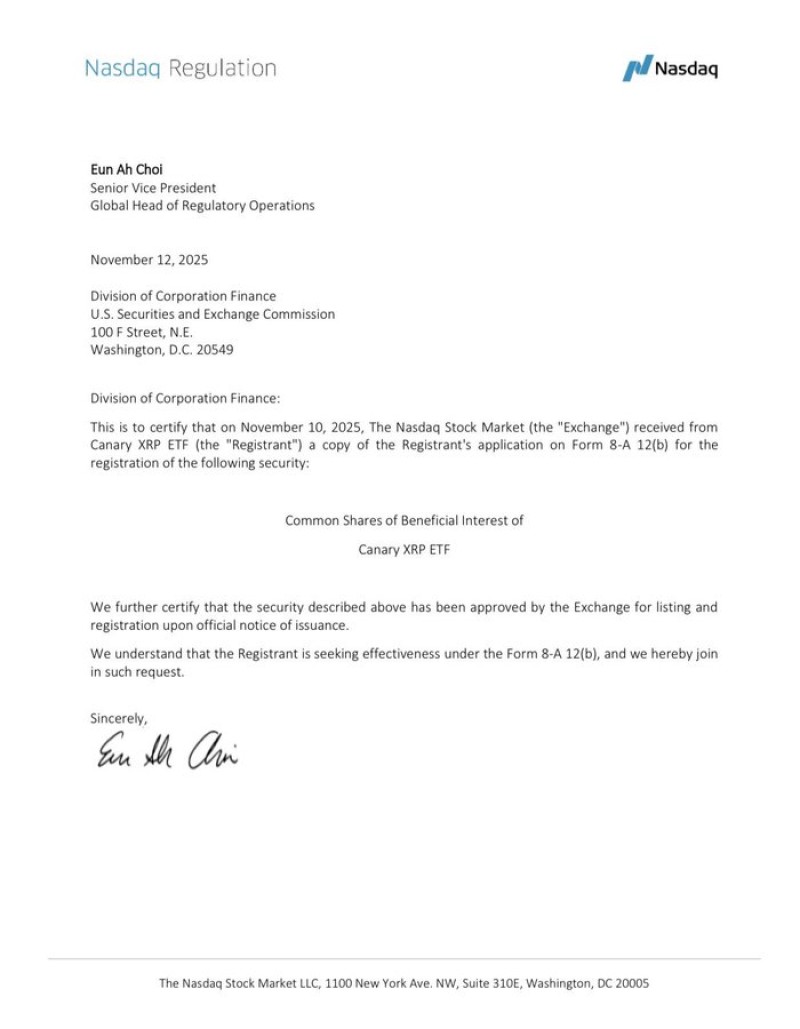

The crypto world is buzzing with excitement as XRP edges closer to a historic milestone. A November 12, 2025 letter from Nasdaq Regulation to the SEC confirms that the exchange has formally processed the Canary XRP ETF's registration under Form 8-A 12(b). This regulatory green light has sparked widespread enthusiasm across the XRP community and marks a pivotal moment for the digital asset's journey into mainstream finance.

The confirmation comes at a time when institutional interest in crypto continues to grow, and a spot ETF could open the floodgates for traditional investors who've been sitting on the sidelines.

What Nasdaq's Letter Actually Says

The certification letter represents more than just procedural paperwork—it's a formal endorsement from one of the world's largest exchanges. Signed by Eun Ah Choi, Senior Vice President and Global Head of Regulatory Operations at Nasdaq, the document provides clear evidence that the Canary XRP ETF has successfully navigated the exchange's rigorous listing requirements.

This kind of regulatory approval doesn't come easily, especially for crypto assets that have faced scrutiny from regulators. The letter lays out several crucial points that underscore just how far along this process has come:

- Application Received: Nasdaq got the Canary XRP ETF's Form 8-A 12(b) application on November 10, 2025

- Listing Approved: The exchange has given the green light to list "Common Shares of Beneficial Interest of Canary XRP ETF" once the official notice of issuance comes through

- Exchange Support: Nasdaq is backing the request for SEC effectiveness, showing the ETF has cleared the exchange's own requirements

- Regulatory Milestone: This represents one of the most significant regulatory steps XRP has ever achieved

Why This Matters for XRP

The ETF news is driving fresh momentum for several reasons. A spot ETF removes major barriers for institutional players, fund managers, and even retirement accounts that couldn't easily hold crypto directly. It also signals growing regulatory confidence in XRP as a legitimate financial product, which is huge considering the asset's legal battles in recent years.

Beyond that, ETFs historically bring serious money into markets. They improve liquidity, tighten spreads, and can support steadier long-term growth as institutional capital flows in. For XRP, this could mean a fundamental shift in how the market behaves.

What Traders Should Watch

Even without looking at price charts, this confirmation is likely to move markets. ETF launches typically create short-term volatility as new money pours in, arbitrage traders position themselves, and speculators make their moves. If the ETF starts trading, XRP could establish stronger support levels as institutional demand kicks in.

Over time, spot ETFs tend to attract more patient, long-term capital, which can smooth out some of the wild price swings crypto is known for. That doesn't mean volatility disappears, but the market structure could mature significantly.

Peter Smith

Peter Smith

Peter Smith

Peter Smith