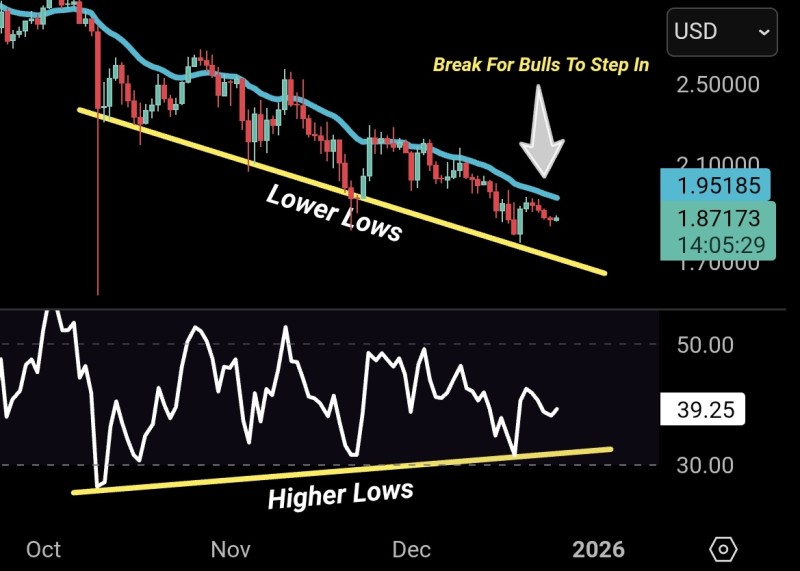

⬤ XRP is sitting close to the $1.95 mark while stuck inside a downward channel that's been printing lower lows on the chart. Some traders are watching to see if bulls can make a move around this level, with a break above $1.95 flagged as a potential trigger. The setup is getting attention as price action tests support heading into the holiday period.

⬤ The chart shows XRP still making lower lows along a descending support line, but here's the interesting part—the Relative Strength Index is forming higher lows at the same time. That's a classic bullish divergence, which usually signals weakening downside pressure. The RSI is hanging around 39.25, still below the neutral 50 line, so momentum hasn't flipped yet. Price candles are also trading under a moving average line, meaning XRP hasn't broken above trend resistance.

⬤ Price readings show XRP bouncing between roughly 1.95185 and 1.87173, staying inside a tight range within the broader downward structure. The combo of improving RSI structure and continued price pressure has traders focused on whether this divergence will actually lead to stabilization or a bounce. So far, the chart is showing early signs of strength, but nothing confirmed yet.

⬤ XRP is trading near the lower end of its recent range while sentiment looks for any real signs of recovery. A clean move above $1.95 would be the signal that momentum is actually improving. How XRP handles this zone could shape short-term expectations and risk appetite in the Ripple market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah