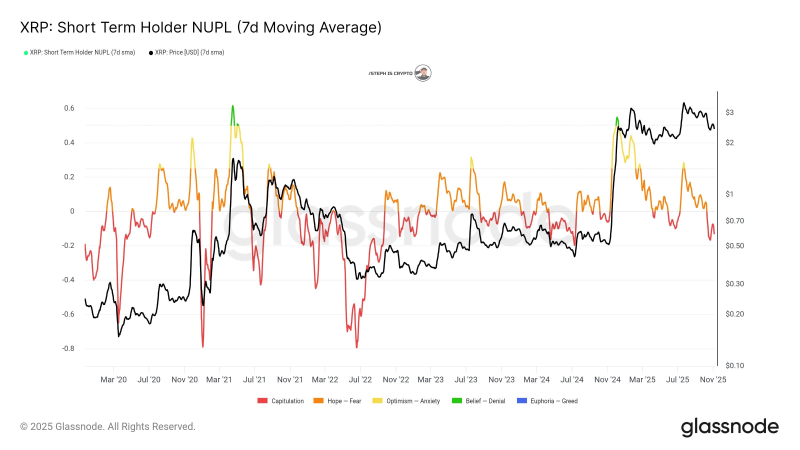

⬤ XRP is drawing attention as new on-chain data reveals stress among recent buyers. A Glassnode chart shared by STEPH IS CRYPTO shows the Short-Term Holder NUPL (Net Unrealized Profit/Loss) has dipped into the red "Capitulation" zone. Past data suggests this signal often comes before significant price reversals.

⬤ The chart shows the 7-day moving average NUPL line dropping below zero, meaning short-term XRP holders are now sitting on unrealized losses. The visual tracks XRP's price cycles since 2020, showing how sentiment has swung through phases like "Hope–Fear," "Optimism–Anxiety," and "Euphoria–Greed."

⬤ This capitulation reading matches the historical pattern highlighted—these phases have typically marked major turning points. However, the chart doesn't predict when or how dramatically prices might shift. It simply shows the pattern that's played out before.

⬤ For XRP watchers, capitulation matters because it flags periods when short-term holders may be panic-selling and sentiment hits rock bottom. While these conditions have historically coincided with market shifts for XRP, investors should consider broader market context and risks. Like any indicator, NUPL offers insight into positioning and sentiment—not a crystal ball.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi