XRP (Ripple) appears to be entering a critical accumulation phase. Recent data reveals that a substantial liquidity cluster is building above the $3.2 mark, suggesting the market might be gearing up for a major move. This concentration of leveraged positions typically attracts institutional attention, as these areas often become targets for liquidation cascades or price discovery events.

Liquidity Map Shows Market Build-Up

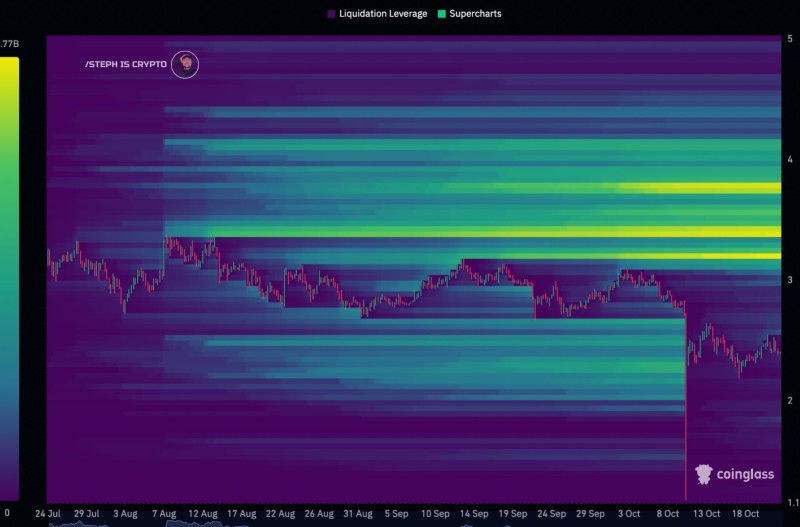

According to trader STEPH IS CRYPTO, a massive XRP liquidity zone is forming just above $3.2. The heatmap data from Coinglass Supercharts shows dense liquidation clusters in bright yellow-green, indicating where high volumes of leveraged trades are positioned. Historically, these concentrated zones tend to pull price action toward them as market makers hunt for efficient order fills.

The chart displays XRP trading within a broad $2.0–$3.0 range since mid-August, creating an extended compression zone. While volatility has decreased recently, liquidity is stacking up at higher levels, particularly between $3.20 and $3.40. This suggests growing leveraged interest in that region. Below current prices, liquidity appears thin, indicating weakening downside momentum. The support zone near $1.8–$2.0 shows minimal liquidation pressure, implying that most traders are betting on upward movement rather than continued decline.

Technical Context

From a structural standpoint, the liquidity density above $3.2 fits typical market maker accumulation patterns. Price tends to consolidate before targeting liquidity-rich areas for more efficient fills. The longer the compression continues, the more explosive the eventual breakout tends to be. Right now, XRP is coiled within a defined range, with leveraged positions building at resistance levels. This creates a powder keg situation where a push above $3.2 could trigger rapid upward acceleration as overleveraged shorts get liquidated.

Market Implications

This liquidity cluster strengthens the bullish argument for XRP in the near term. When volatility compresses and liquidity pools tighten above resistance, markets often experience sharp directional moves once those zones get tested. If XRP pushes toward $3.20, forced liquidations among overleveraged short positions could fuel a quick climb toward $3.5–$4.0, based on the upper density layers visible in the heatmap. On the flip side, failure to maintain momentum could keep the asset range-bound until broader market liquidity shifts occur.

The current setup suggests quiet accumulation before potential volatility expansion. With liquidity now clustering above key resistance levels, XRP traders are watching closely, waiting for the next decisive move that could define the coin's path through the final quarter of 2025.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov