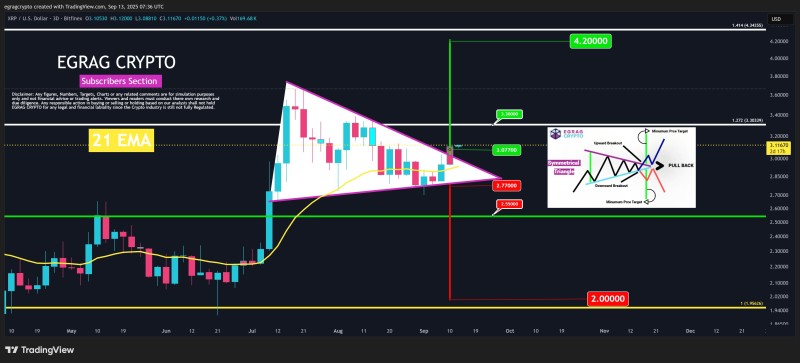

XRP is coiled like a spring right now. After weeks of sideways action, the price has squeezed into a tight symmetrical triangle on the 3-day chart, and something's got to give. The setup is pretty straightforward. We've got equal chances for an upward or downward break, but the market's leaning bullish if XRP can stick above that $3.07 level. That price lines up perfectly with the 21 EMA, making it even more significant as a resistance-turned-support zone.

Key Levels That Matter

Analyst EGRAG CRYPTO points out that while these patterns can break either way, the key thing to watch is whether bulls can punch through $3.07 - that's where the real action starts.

Here's what traders are watching:

- Breakout trigger: $3.07 (21 EMA alignment)

- First upside target: $3.30

- Major bullish target: $4.20 (Fibonacci extension)

- Critical support: $2.77, then $2.55

- Bearish invalidation: Break below $2.55 opens door to $2.00

The math is simple - a confirmed close above $3.07 flips the script bullish and could send XRP on a run toward $3.30 first, with $4.20 as the ultimate target based on technical projections. But if we can't hold above support at $2.77, things get ugly fast. A drop below $2.55 would basically trash the whole bullish setup and potentially drag XRP down to $2.00.

The broader crypto market is showing signs of life again, which could provide the tailwind XRP needs to break higher. But triangles are tricky - they can explode in either direction with equal force. The next couple of daily closes will tell the whole story.

Right now it's a waiting game. Bulls need that clean break and hold above $3.07 to confirm the breakout. Bears are hoping for a fake-out that leads to a breakdown below key support. Either way, the next move should be significant given how compressed the price action has become. This is exactly the kind of setup that can lead to explosive moves in crypto.

Peter Smith

Peter Smith

Peter Smith

Peter Smith