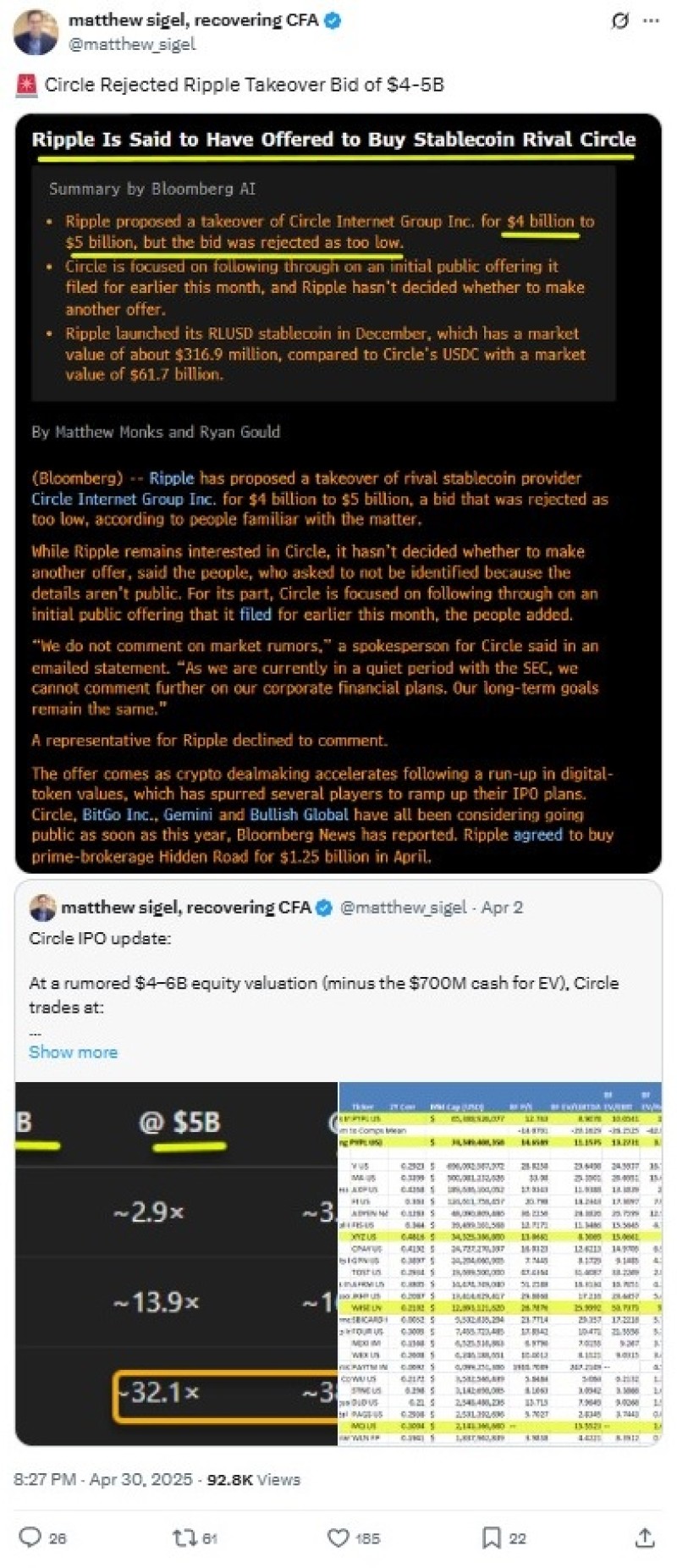

Ripple (XRP), the San Francisco-based enterprise blockchain company, recently approached stablecoin giant Circle with a substantial acquisition offer valued between $4-5 billion. However, Circle, the issuer of the popular USD Coin (USDC) stablecoin, rejected the proposal, believing it undervalued the company.

XRP's Strategic Move to Dominate Stablecoin Market

The acquisition attempt represents a bold strategic move by Ripple (XRP) to strengthen its position in the rapidly growing stablecoin sector. With Circle's USDC currently holding a market capitalization of $62 billion, such an acquisition would have instantly positioned Ripple as a dominant force in the stablecoin ecosystem.

Ripple launched its own stablecoin, Ripple USD (RLUSD), last year, which has already achieved a market capitalization exceeding $300 million. However, this pales in comparison to USDC's established market position as the second-largest stablecoin behind Tether's USDT and the seventh-largest cryptocurrency overall.

Circle (USDC) Pursues IPO Path Instead of XRP Acquisition

Circle appears firmly committed to its initial public offering (IPO) trajectory, having filed the necessary paperwork in early April to go public in the United States. When approached for comment on the potential acquisition, Circle declined to address what it described as "market rumors," maintaining focus on its public offering plans.

The timing of Ripple's offer is particularly noteworthy as it comes during Circle's preparations for its public market debut. The $5 billion valuation represents the upper limit of Ripple's proposed offer range, suggesting the blockchain company recognizes Circle's significant market value and potential.

XRP Remains "Acquisitive" Following $1.25 Billion Hidden Road Deal

This acquisition attempt aligns with recent statements from Ripple President Monica Long, who indicated that the company was not interested in going public itself but was instead in an "acquisitive" position. This strategy was demonstrated earlier this month when Ripple announced its decision to purchase prime brokerage Hidden Road for $1.25 billion—one of the largest deals in cryptocurrency industry history.

Ripple hasn't completely abandoned its interest in acquiring Circle despite the initial rejection. The company is reportedly considering whether to formulate another offer, though no decisions have been finalized.

Past Acquisition History of Circle (USDC)

Circle itself has experience with major acquisitions, having famously purchased cryptocurrency exchange Poloniex for $400 million in 2018. However, that particular venture proved unsuccessful, with Circle eventually losing approximately $156 billion on the deal. As reported by U.Today, Poloniex was spun out of Circle in late 2019 as part of a corporate restructuring effort.

The stablecoin market has become an increasingly crucial battlefield in the cryptocurrency industry, with USDC and USDT (Tether) dominating the space. Ripple's interest in Circle highlights the strategic importance of stablecoins in the broader digital asset ecosystem, particularly as institutional adoption continues to grow.

Should Ripple (XRP) eventually succeed in acquiring Circle, it would represent one of the most significant consolidations in cryptocurrency history, potentially reshaping competitive dynamics in both the payment protocol and stablecoin sectors.

Usman Salis

Usman Salis

Usman Salis

Usman Salis