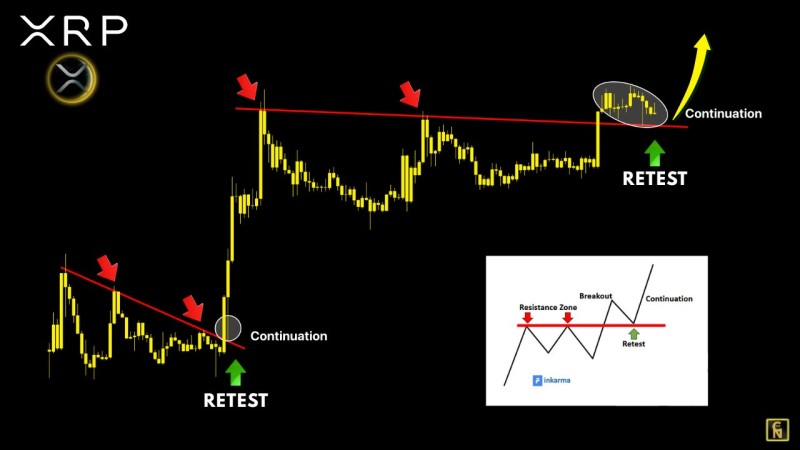

⬤ XRP has been consolidating since its sharp December 2024 breakout, spending the past year retesting what was a multi-year resistance trendline. This line capped price action for nearly seven years before finally breaking through. The chart shows repeated touches of this former resistance, which is now acting as support instead of pushing price back down.

⬤ Rather than reversing immediately after breaking out, XRP entered a prolonged consolidation phase. Multiple dips back toward the trendline have held firm, creating what looks like a reaccumulation pattern. Each test of this level has respected the support so far, which strengthens its technical importance. The price remains comfortably above the trendline without any breakdown.

⬤ Looking back at the 2017 cycle, XRP showed a similar pattern after breaking a long-term resistance trendline. Back then, it also went through an extended consolidation before continuing higher. The current setup mirrors that historical behavior, with a drawn-out retest playing out instead of a quick move upward. Recent candles show XRP still holding above the trendline with no confirmed break to the downside.

⬤ This extended retest is significant for understanding market structure. When an asset consolidates above former resistance for this long, it typically signals trend acceptance rather than weakness. If XRP keeps holding above this level, the technical picture stays aligned with a continuation scenario. How this retest phase resolves will determine whether the broader uptrend resumes, similar to what happened in previous cycles.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah