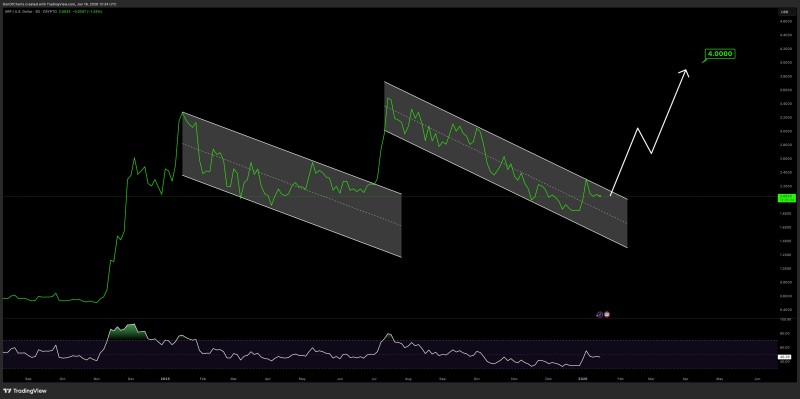

⬤ XRP has been trading inside a well-defined descending channel for several months now, and this pattern is getting attention as a classic bullish reversal formation. The price has been making lower highs and lower lows while staying within the channel boundaries, showing that the structure is holding up. Each time XRP touches either the top or bottom of the channel, it bounces back, which confirms the pattern is still in play.

⬤ Here's the thing about descending channels—they don't always mean the price is going to keep falling. Often, they're just a way for the market to cool off after a big move up. Right now, XRP is sitting in the middle to lower part of the channel, and it looks like the selling pressure is starting to fade. As one analyst noted, "sellers are losing strength as price compression tightens, a condition that often precedes a decisive move." When price gets squeezed like this inside a narrowing range, it usually means something's about to give.

⬤ If XRP manages to break above the upper trendline of this channel, technical projections suggest the price could head toward $4 in the short term. That target comes from measuring the height of previous price moves and lines up with an important psychological level. But until that breakout actually happens, XRP is still stuck in this range, just building pressure for what could be the next big move.

⬤ Descending channels have a habit of resolving with sudden, strong price movements once resistance finally breaks. A clean breakout above the channel would signal that momentum has shifted and could trigger faster upside action. If the price stays inside the channel, expect more sideways movement. Either way, XRP's current setup suggests a decision point is coming soon as the compression continues to build.

Peter Smith

Peter Smith

Peter Smith

Peter Smith