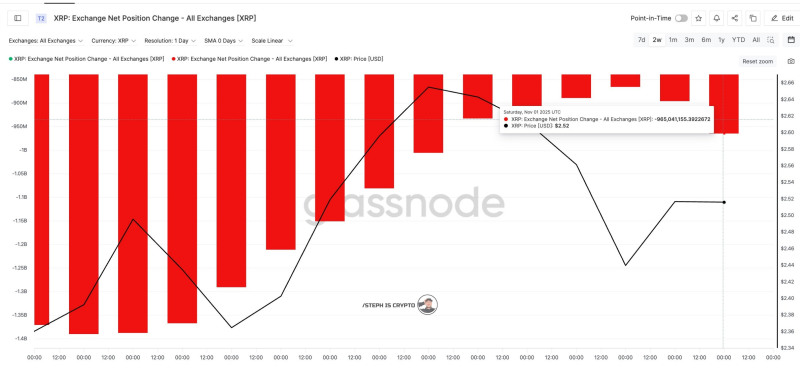

● According to Steph Is Crypto, on-chain data from Glassnode shows a massive drop in XRP held on exchanges — roughly 965 million tokens have been withdrawn. This continued exodus from centralized platforms is generally seen as bullish, since it suggests investors are moving coins into private wallets for long-term holding rather than keeping them ready to sell.

● The trend indicates XRP holders are becoming more confident about future price gains. When large amounts of tokens leave exchanges, available supply tightens, which can push prices higher if demand picks up. The flip side? Thinner order books can make the market more volatile, especially if there's sudden selling pressure or heavy leverage in play.

● Despite these massive outflows, XRP's price is holding steady around $2.52, just under its recent high of $2.64. This stability while supply shrinks suggests the market might be setting up for a breakout. If institutional money or renewed retail interest comes in, the reduced supply could fuel a significant rally.

● This pattern fits the broader altcoin market, where investors are increasingly choosing to hold long-term as regulatory uncertainty clears up. With XRP now officially recognized as a non-security in several jurisdictions, it's attracting both retail traders and institutions interested in cross-border payment solutions.

XRP exchange balances just dropped again. Outflows jumped to –965M XRP. Less supply on exchanges = bullish pressure! As StephIsCrypto puts it

● The takeaway: with exchange supplies shrinking and confidence building, many traders are watching XRP closely for a potential bullish run in the coming weeks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis