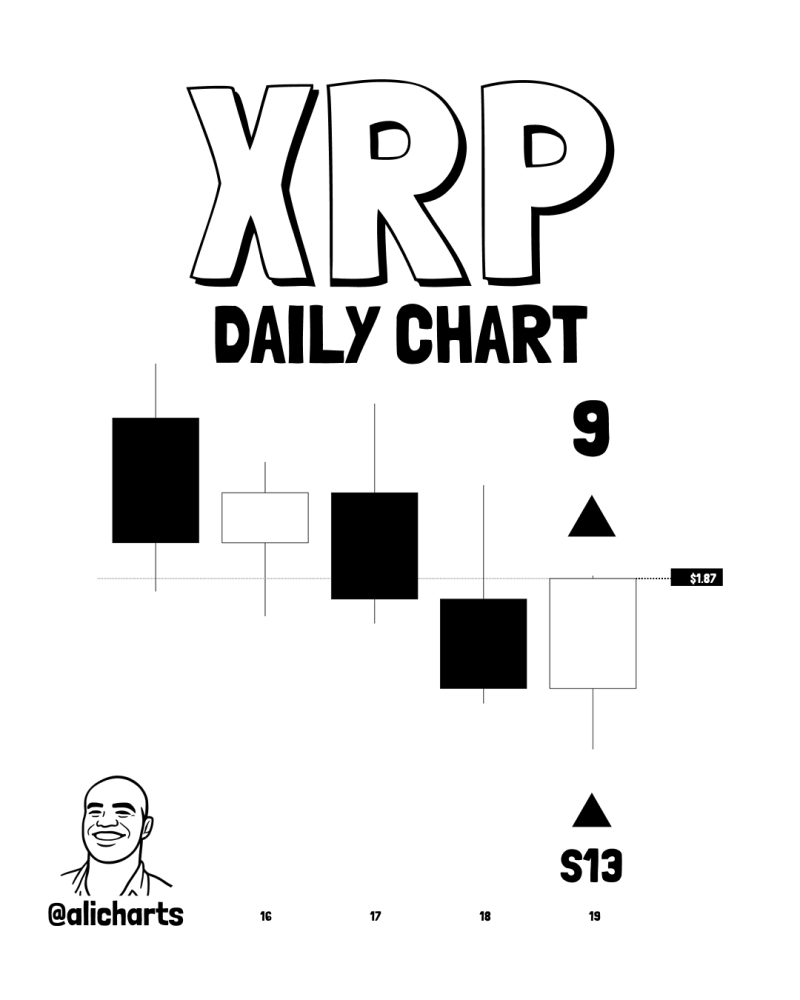

⬤ XRP just flashed a TD Sequential buy setup on the daily timeframe after pulling back over several sessions. The chart shows the signal forming around $1.87, where price started slowing down instead of continuing to dump. This indicator has a track record of appearing right when markets hit pause after local drops, suggesting we might see some stabilization or a bounce here.

⬤ The TD Sequential works by counting consecutive candles moving in one direction to spot potential exhaustion. When it completes a buy count like this, it's telling us selling pressure might be running out of steam. What's interesting here is that while XRP did wick lower, it couldn't hold those losses and kept bouncing back above the key level. That's classic absorption behavior—when the market starts digesting supply rather than folding under it.

⬤ Right now, XRP is trading in a pretty tight range after this signal appeared. We're not seeing a full reversal confirmation yet, but the bearish candles definitely lost their punch compared to earlier sessions. These TD Sequential buy signals have historically lined up with consolidation periods or counter-trend bounces, especially after a string of down days. The setup is basically asking whether this pullback has played itself out.

⬤ Looking at the bigger picture, this technical signal fits into what we're seeing across other major cryptos—momentum cooling off across the board. If XRP holds above this support zone, it backs up the idea that the selling pressure has eased for now. Breaking below would kill the signal and open the door to more downside, but as long as price stays stable here, the focus shifts to whether XRP can flip from consolidation mode into an actual recovery.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah