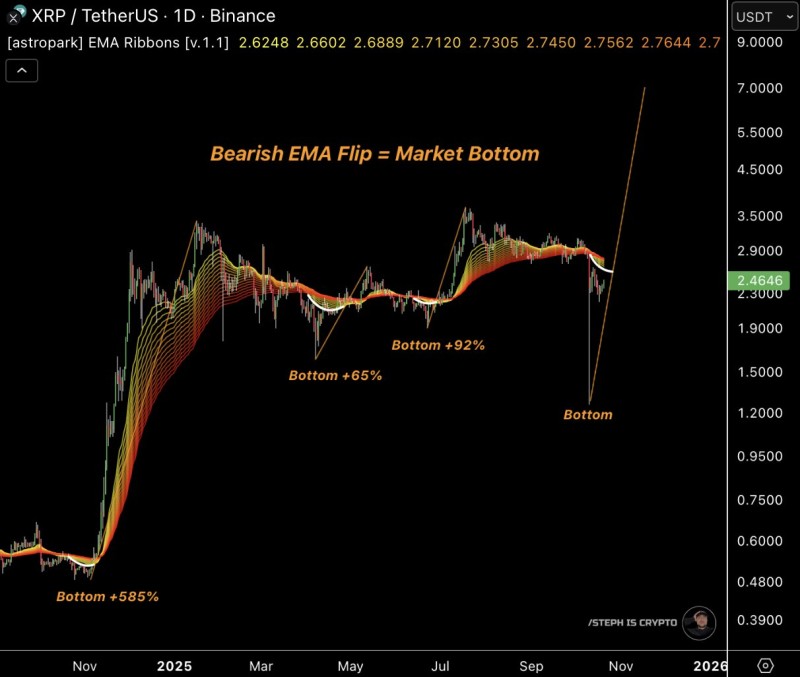

After weeks of choppy price action, XRP might finally be flashing its most dependable reversal signal. Based on the chart, this setup has come before every significant XRP rebound in the past cycle, hinting that the market could be preparing for another strong move up.

The Pattern That Keeps Working

Analyst STEPH IS CRYPTO recently pointed out that the token's bearish EMA flip has appeared again—a technical marker that's historically signaled major bottoms. The XRP/USDT daily chart from Binance shows a striking pattern: each time the EMA ribbons flip bearish, it marks a bottom—followed by a solid rally. These ribbons, displayed in shades of red, orange, and yellow, track short- to mid-term exponential moving averages that measure trend strength. Here's what stands out:

- Late 2023 bottom: The bearish flip was followed by a +585% rally

- Early 2024 bottom: Led to a +65% surge

- Mid-2024 bottom: Produced a +92% gain

- Current setup: XRP just printed another bearish flip near $2.30–$2.40 and is now stabilizing around $2.46

- EMA compression: The narrowing ribbons suggest trend exhaustion—typically a sign that a breakout is coming

What makes this interesting is the consistency. After each flip, XRP consolidates briefly, then takes off. The chart even projects potential targets around $5.00–$6.00 if the pattern repeats, though that's obviously speculative.

Why This Signal Actually Works

A bearish EMA flip sounds negative at first—short-term averages dropping below long-term ones usually means trouble. But for XRP, it's been the opposite. These flips happen after extended selling pressure when the market is exhausted and most sellers have already bailed. That's when buyers quietly step in, and the reversal begins. It's a sentiment shift from fear to accumulation, and the chart shows it works.

Right now, XRP is holding up while Bitcoin consolidates above $65,000 and liquidity rotates into altcoins—especially Layer-1 and payment-focused tokens. With Ripple's recent legal clarity and XRP's role in cross-border payments, the technical signal is lining up with solid fundamentals. For traders watching long-term setups, this could be one to pay attention to.

Usman Salis

Usman Salis

Usman Salis

Usman Salis