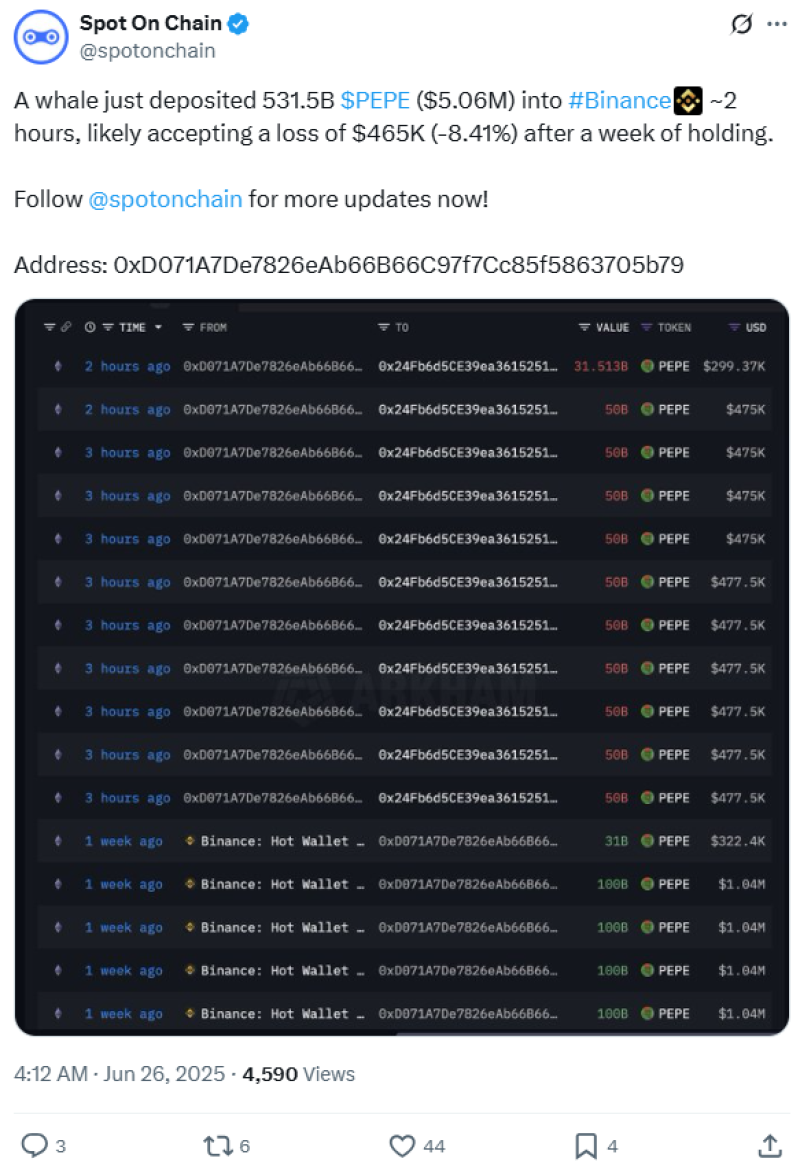

The crypto world just witnessed an epic whale meltdown as someone with seriously deep pockets decided they'd had enough of PEPE and dumped a mind-boggling 531.5 billion tokens straight onto Binance. We're talking about $5.06 million worth of frog-themed digital assets here.

Here's where it gets really painful: According to SpotOnChain, this whale had only been holding these PEPE tokens for about a week before pulling the ripcord. They took a massive $465,000 hit doing it, which works out to an 8.41% loss on their original investment. When someone's willing to eat nearly half a million in losses after just seven days, they either saw something scary coming or couldn't handle the meme coin volatility.

PEPE Gets Caught in Market Carnage

PEPE didn't pick the best week to have a whale freakout. The entire crypto market has been bleeding during Thursday's session, with traders taking profits after earlier weekly gains and macroeconomic jitters adding fuel to the fire. The carnage has been spectacular, with $228 million in leveraged positions getting wrecked market-wide.

Right now, PEPE is sitting at $0.00000928, down 6.98% in the last 24 hours and 11% weekly. The recent beating has been brutal enough to add another zero to PEPE's price – never a good look in crypto. If today ends red, PEPE will have posted back-to-back daily losses.

PEPE Charts Show Mixed Signals

Here's where things get weird: Despite all the doom and gloom, PEPE's daily chart just flashed a "golden cross" – when the 50-day moving average crosses over the 200-day moving average. This usually hints at bullish momentum building up, but the market is basically shrugging at this typically bullish signal.

Why? Because when you've got whales dumping massive positions and liquidations happening everywhere, technical patterns take a backseat to raw selling pressure. You've got this potentially bullish setup trying to emerge while the actual price action tells a completely different story.

What This Whale Move Means for PEPE (PEPE)

Someone put over $5 million into PEPE and bailed after just one week with a massive loss. That's either panic selling or someone who got spooked by what they saw coming. When whales start capitulating like this, it either means we're near a local bottom or there's more pain ahead.

The reality is that dumping 531 billion tokens onto Binance is going to move the market. Even though PEPE has decent liquidity, that kind of selling pressure leaves a mark. Seeing whales take massive losses doesn't exactly inspire confidence in retail investors sitting on similar positions.

This dramatic whale behavior highlights how quickly sentiment can shift in the meme coin space. One week you're buying billions of tokens, the next you're cutting losses and moving on. That's crypto for you – never a dull moment.

Peter Smith

Peter Smith

Peter Smith

Peter Smith