Coinbase (COIN) isn't messing around anymore. After staying quiet for four years, they just fired up their Stablecoin Bootstrap Fund and are throwing serious money at USD Coin (USDC) liquidity. This looks like all-out war for stablecoin supremacy.

Coinbase's USDC Attack Strategy Revealed

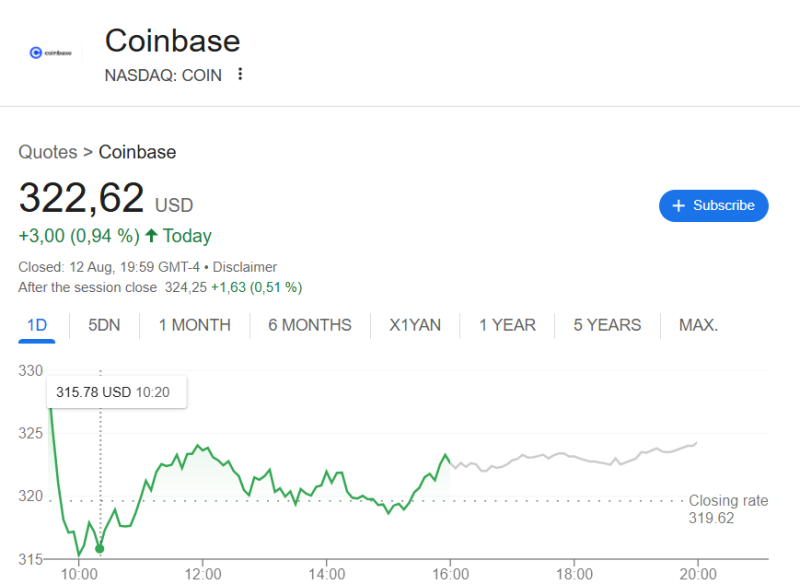

On August 12, Coinbase made their move – injecting capital into DeFi platforms to boost USDC and EURC liquidity. But this isn't just funding; it's strategic warfare.

They're hitting where it hurts most. Aave and Morpho on Ethereum get funding to dominate lending, while Solana's Kamino and Jupiter (JUP) get cash for cross-chain control. Smart move – control the infrastructure, control the game.

USDC already handles $8.9 billion in total value locked and moves $2.7 trillion yearly across Ethereum, Base, Solana (SOL), and Sui (SUI). Now Coinbase wants to make that dominance unbreakable.

Why Coinbase (COIN) USDC Gamble Could Crush Competition

That $2.7 trillion volume isn't luck – it's Coinbase building the rails everyone else needs. While Tether focuses offshore, Coinbase is going full institutional with regulatory backing.

The timing's perfect. Crypto ETFs are live, institutions are flooding in, and DeFi's going mainstream. Coinbase waited four years for this exact moment to strike.

USDC Price Prediction: Total Market Takeover Incoming

This isn't about keeping USDC at $1 – it's about making competitors irrelevant. Better liquidity means fewer depegging scares, which means more institutions choose USDC over everything else.

Coinbase's message is crystal clear: they're done playing defense. This Bootstrap Fund restart could be the killing blow that makes USDC the only stablecoin that matters.

Peter Smith

Peter Smith

Peter Smith

Peter Smith