TRX is testing key resistance at $0.3177 while whale transactions surge 404%, setting up a make-or-break moment for TRON's next price move.

TRON's sitting at a crossroads right now. The fundamentals look solid, whales are making big moves, and everyone's betting on higher prices – but there's one massive obstacle standing in the way.

TRX is bumping up against resistance at $0.3177, which lines up perfectly with the 1.618 Fibonacci extension. Currently trading at $0.3148, it's literally knocking on the door. The DMI shows a strong trend (ADX at 46), but bullish momentum is fading with +DI at 27 and -DI at 13.

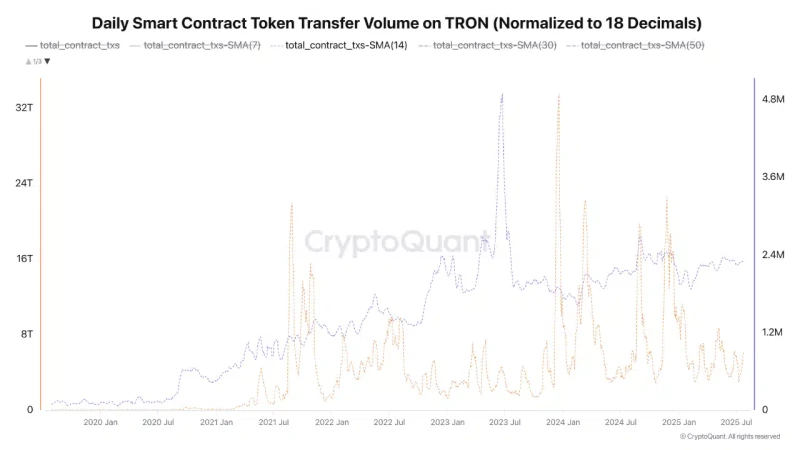

The network itself is humming along nicely. TRON's smart contract activity is steady at 2.35 million daily transactions – people are actually using DApps and DeFi platforms. But here's the weird part: transfer volume is bouncing all over the place around 4.90 trillion tokens, with random spikes that scream whale activity.

That disconnect matters. While regular users are doing their thing, these massive volume spikes mean big players are moving serious money. Could lead to some wild swings when those whale movements hit.

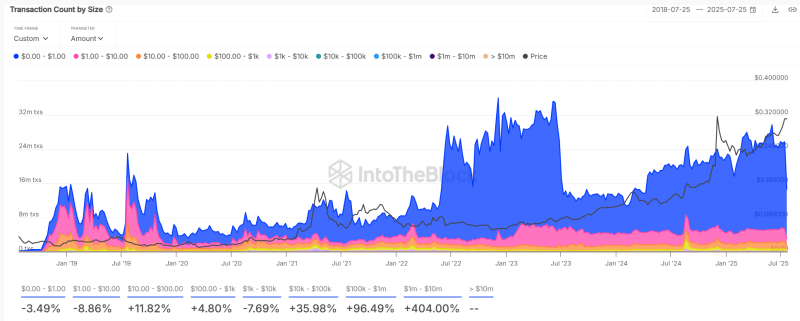

TRX (TRON) Whales Go Crazy with 404% Transaction Surge

Now here's where it gets nuts. Transactions above $1 million have exploded by 404%. That's not a typo. While smaller trades are flat or even down, the big money is moving like crazy.

This kind of whale action doesn't happen randomly. When people are moving millions in TRX right as it tests major resistance, they're either betting big on a breakout or positioning for something major. The timing is too perfect to be coincidence.

IntoTheBlock's data shows this is the largest growth segment among all transaction sizes. Usually, this kind of institutional activity happens before big price moves. Question is: are they betting up or down?

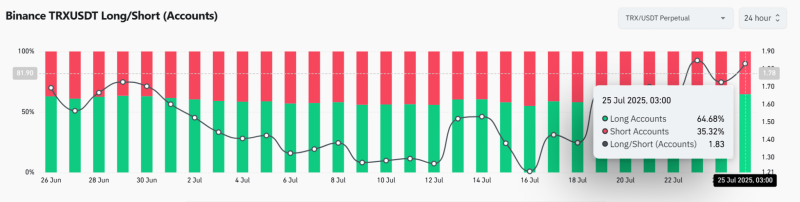

TRX (TRON) Bulls Crowded as Liquidation Zones Create Danger

Here's the scary part for bulls. The Long/Short Ratio hit 1.83 on Binance, with over 64% holding long positions. That's a lot of people on the same side of the trade, which gets dangerous fast.

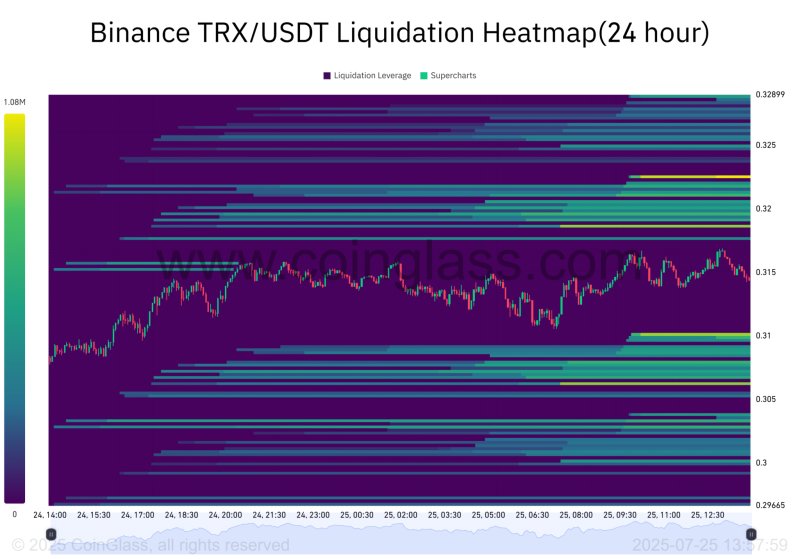

Coinglass liquidation heatmaps show dense clusters at $0.317 and $0.328. These are the kill zones where overleveraged traders get wiped out. If TRX breaks above $0.328, short liquidations could rocket the price higher. But if it fails at $0.317, long liquidations could create a nasty drop.

It's like dominoes – once the liquidations start, they cascade. Small moves can trigger massive reactions because of all the leverage sitting there.

The critical level is $0.3235. Close above that, and we're probably looking at a run to $0.3491. Fail, and expect a pullback toward $0.2983.

Bottom line: TRON's got everything lined up for a rally – solid network usage, whale positioning, bullish sentiment. But that resistance at $0.3177 is make-or-break. The whale activity suggests big players think something's about to happen. Whether that's up or down depends on if TRX can finally punch through this level.

With all those crowded longs and liquidation clusters nearby, the next move could be explosive either way. The fundamentals support higher prices, but the technicals need to cooperate first.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah