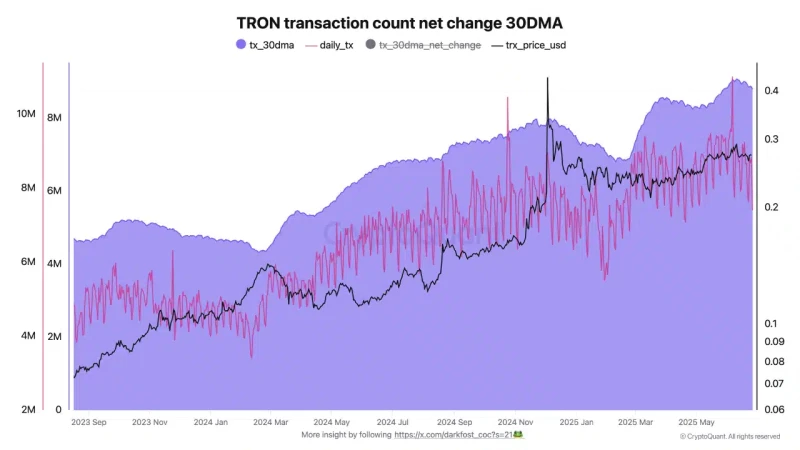

TRON's network activity jumped from 5 million to 9 million daily transactions since September, but TRX faces tough resistance as it trades at $0.2713.

TRON [TRX] has been quietly making moves, and the numbers show it. Daily transactions nearly doubled since September 2023, rising from under 5 million to almost 9 million monthly. That's genuine network growth after a rough bear market period.

At $0.2713, TRX reflects this renewed activity. TRON's decision to slightly raise fees (paid in TRX) has created stronger functional demand. People actually need TRX to use the network now, not just for speculation - that's the kind of demand that sticks around.

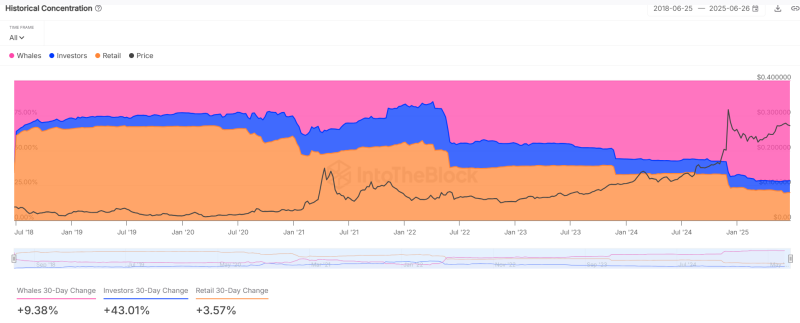

Big Players Are Loading Up on TRX While Retail Stays Back

The whale data tells a clear story. Large holders increased TRX holdings by 9.38% over 30 days, while investor-level wallets surged 43.01%. Retail? Only 3.57% growth.

This split usually means smart money sees something retail hasn't caught onto yet. When whales and serious investors buy while retail sits out, it creates a solid price foundation. If retail eventually jumps in, all that whale accumulation could act like a safety net under TRX's price.

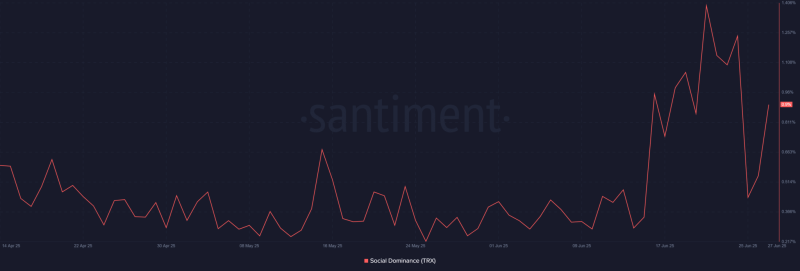

TRX Social Buzz Hits 1.4% - Hype Train Starting?

After months under the radar, TRON's getting attention again. TRX's Social Dominance spiked past 1.4% according to Santiment, though it's cooled slightly. This means TRX generated over 1% of all crypto conversations online.

Social spikes like this often signal more trading action ahead, especially with bullish sentiment and continued network growth.

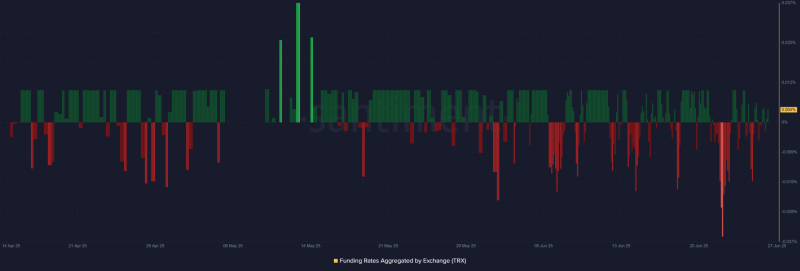

But not everything's rosy. TRX's funding rates have been erratic - brief positive bursts followed by negative rates, showing bearish tilt in futures markets. This uncertainty among traders is concerning, but it also reduces risk of excessive leverage that could crash the price.

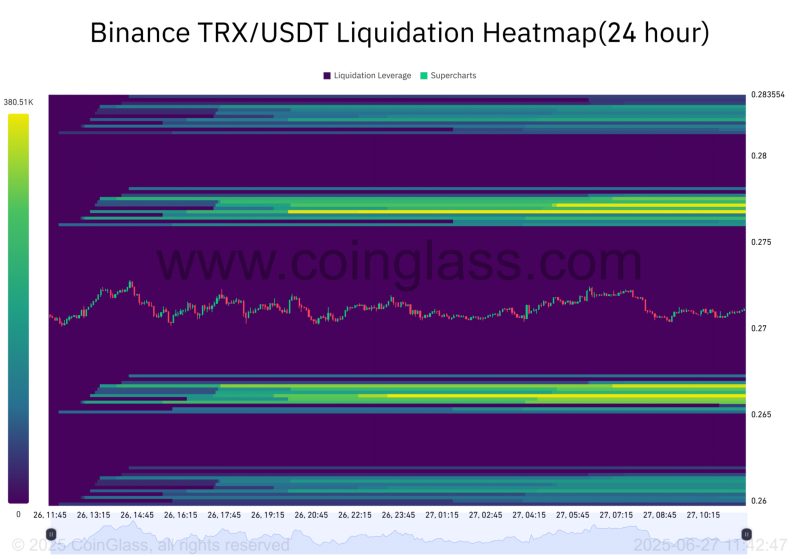

TRX's technical picture is tricky. The 24-hour liquidation heatmap shows dense clusters between $0.275-$0.283, creating major resistance. Large leveraged positions stacked here mean price spikes could trigger forced liquidations.

Downside clusters between $0.265-$0.26 create a tight trading band. Unless buyers push convincingly above $0.28, TRX risks staying trapped between these levels, especially under macro volatility.

The bottom line? TRON's fundamentals look solid - surging transactions, whale accumulation, and growing social interest point to real network growth. But cautious derivatives sentiment and that $0.28 resistance wall remain serious challenges.

TRX's success depends on whether whales maintain buying pressure and if social buzz translates into actual retail investment. If both happen, TRX could break through resistance and find higher ground.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah