⬤ A massive deleveraging shook the crypto markets when Trend Research was forced to slash its enormous Ethereum position. The firm had accumulated a leveraged long position worth roughly $2.6 billion in ETH, with an average entry price around $3,267.

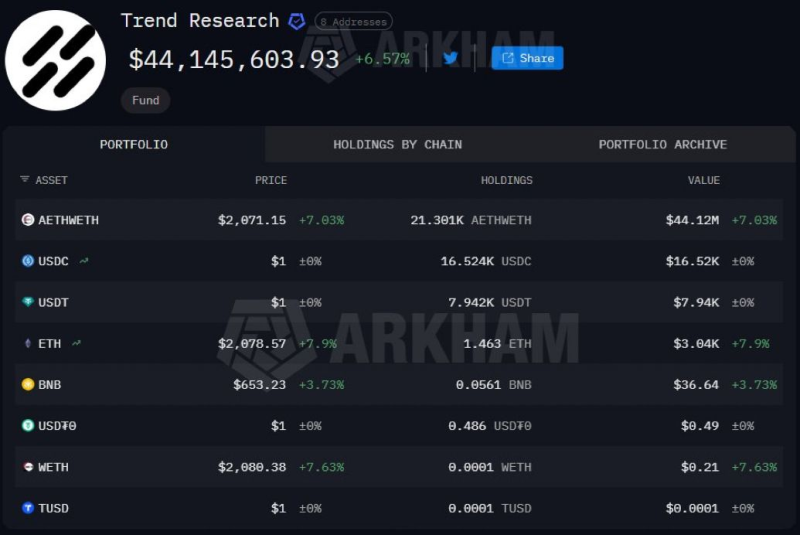

⬤ When the market turned south, things got ugly fast. The company had no choice but to dump approximately $1.8 billion in ETH at an average price near $2,326 just to pay back the loans backing their leveraged bet. The damage? A staggering $750 million loss. After the dust settled, Trend Research walked away with only about $44 million in Ethereum—a fraction of what they started with.

⬤ What's left in their portfolio tells the story: mostly Ethereum-related assets with some stablecoins on the side. The gap between their $3,267 buy-in and the $2,326 fire-sale price shows exactly how leverage can turn market moves into a bloodbath. This isn't the first time we've seen large liquidations hit crypto markets with devastating force.

⬤ These kinds of mega-liquidations don't just hurt the traders involved—they ripple through the entire market. When someone's forced to sell this much this fast, it dumps a ton of supply onto the market all at once, cranking up volatility and messing with prices across the board. The forced selling pressure across digital assets can trigger a chain reaction that hits way more than just one unfortunate firm.

Usman Salis

Usman Salis

Usman Salis

Usman Salis