Stellar's XLM price is showing bearish signs after a weak performance this week, with technical indicators and negative sentiment pointing to potential further losses.

Stellar's XLM has been struggling lately, and the charts aren't looking pretty. After a disappointing week, several warning signs are starting to pile up that could spell trouble ahead for this altcoin.

Stellar (XLM) Price Hits Bearish MACD Crossover

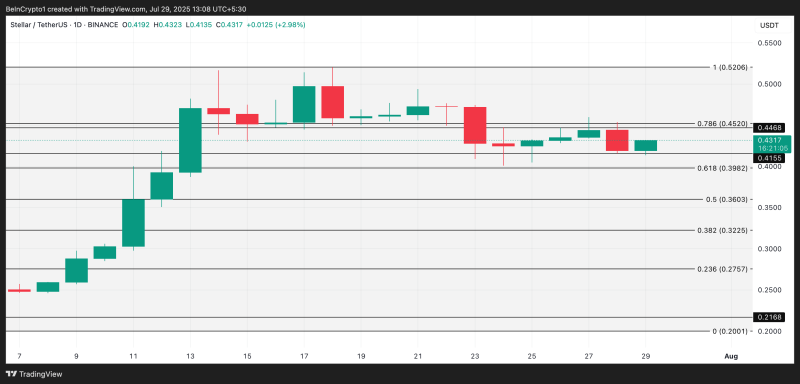

Looking at the daily XLM/USD chart, things got interesting on July 24 when the MACD indicator formed a bearish crossover. This happens when the MACD line (blue) drops below the signal line (orange) - basically telling us that short-term momentum is weakening compared to the longer-term trend.

Since this crossover appeared, XLM has been stuck in a pretty tight range. It's been hitting resistance around $0.44 while finding some support at $0.41. This sideways action shows that the bulls have lost steam, and traders seem unsure about which way to go next.

The lack of strong movement in either direction isn't great news for XLM holders. If that $0.40 support level starts to crack, we could see some real downside action.

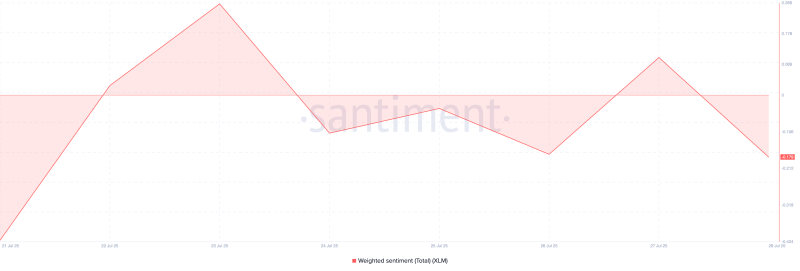

XLM Price Sentiment Turns Sour

It's not just the technicals that are concerning - the overall vibe around XLM has turned negative too. According to Santiment, XLM's weighted sentiment is sitting at -0.179, which adds more fuel to the bearish fire.

When sentiment goes negative like this, it usually means people are getting skeptical about the token's prospects. This creates a bit of a snowball effect - as investors lose confidence, they trade less, which can push prices down even further.

STELLAR Price: What's Next?

Right now, XLM is trading at $0.43, down 2% as the broader crypto market takes a hit. If this negative mood continues and we don't see any fresh buying interest, XLM could break out of its current range and head down to $0.39.

But crypto markets can flip quickly. If sentiment improves and buyers step back in, XLM could reverse course, break through that $0.44 resistance, and potentially rally toward $0.45. It's all about whether the bulls can regain control or if the bears will keep pushing lower.

Usman Salis

Usman Salis

Usman Salis

Usman Salis