Stellar's XLM token has exploded 85% this week, smashing through a months-long downtrend and eyeing some seriously ambitious targets. If the bulls keep this momentum going, we could see XLM hit $1 and even $1.50.

XLM Price Smashes Through Key Resistance Levels

XLM just delivered one hell of a performance, breaking out of a descending channel that's been holding it back since December. The breakout happened around $0.26 and came with a textbook double bottom pattern – lows around $0.23 and a neckline at $0.33.

Once XLM cleared that $0.33 neckline, things got wild. The token rocketed over 85%, blowing past the expected target of $0.45 and proving the bulls mean business. This isn't just any pump – it's a proper technical breakout that traders have been waiting for.

The fact that XLM managed to hold above these key levels shows the market has seriously shifted. Bears are backing down, and the bulls are running the show now.

XLM Price Eyes $1 Target After $0.52 Resistance

Here's where things get interesting. XLM is now approaching the January peak at $0.52, which lines up perfectly with the 0.236 Fibonacci level. This is make-or-break territory.

If XLM can punch through $0.52 cleanly, the next stop is around $1 – that's the 1.618 Fibonacci extension level. And if the buying doesn't stop there? We're looking at $1.50 as the ultimate target, sitting at the 2.618 extension.

But let's be real here – the RSI is sitting above 86, which is crazy overbought territory. Some pullback around $0.52 wouldn't be surprising. The key thing to watch is whether XLM can hold the $0.33-$0.36 zone as support during any dip. If it does, those higher targets are definitely in play.

Stellar (XLM) Rally Backed by Real Network Growth

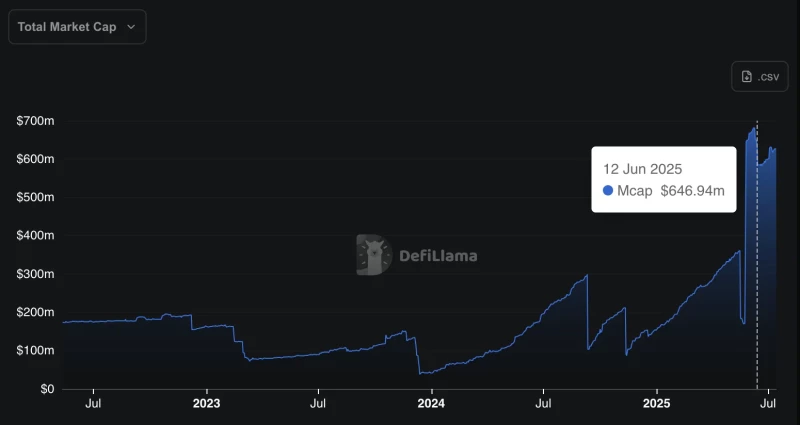

This isn't just another crypto pump – there's real substance behind XLM's move. The Stellar network has been crushing it lately, with stablecoin supply jumping from just $44 million to a record $647 million in mid-June, according to DeFiLlama.

That's not all. Futures open interest has spiked to $345 million – the highest we've seen since January. When you combine massive stablecoin growth with increased futures activity, it's clear that both retail and institutional players are getting serious about XLM.

This kind of fundamental backing gives the technical breakout some real legs. When the charts align with actual network usage and growing institutional interest, that's when you get sustained rallies that can really surprise people.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah