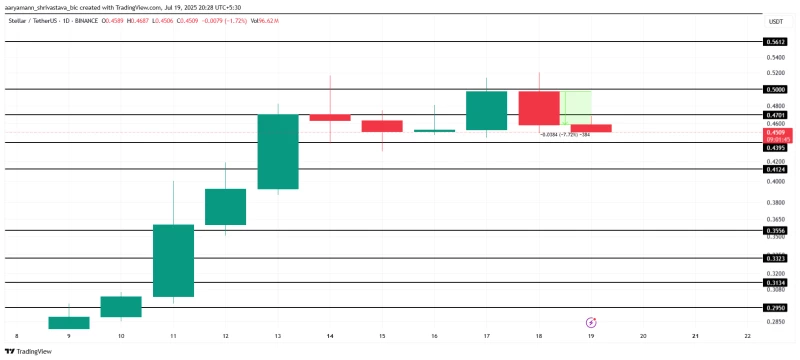

Stellar (XLM) is struggling to break past $0.50 resistance after a 7% drop, with technical indicators showing mixed signals for the cryptocurrency's next move.

Stellar (XLM) just can't seem to catch a break. After what looked like a solid rally, the altcoin has hit a brick wall at $0.50 and dropped 7% in the last 24 hours to trade at $0.45. It's been stuck under this resistance for a full week now, and frankly, it's starting to look pretty concerning for anyone holding XLM.

The recent volatility tells us something's brewing. Either we're about to see a breakout, or things could get uglier from here. Right now, the technical picture is sending mixed messages, which always makes traders nervous.

What's really catching attention is how quickly sentiment has shifted. Just last week, everything looked bullish for Stellar. Now? Not so much. The cryptocurrency is sitting at a crossroads, and the next few days will likely determine whether this is just a temporary pause or the start of something more serious.

XLM Price Technicals Paint a Messy Picture

Here's where things get interesting from a technical standpoint. The Parabolic SAR has flipped above the candlesticks, which is trader-speak for "the bears are taking control." This indicator is basically screaming that downward momentum is building, making it even harder for XLM to push past that stubborn $0.50 level.

But wait – there's a plot twist. We've got an active Golden Cross happening right now, which is typically a pretty bullish signal. This formation suggests long-term upward movement could still be on the table. So we're literally seeing a battle between short-term bearish pressure and longer-term bullish structure.

It's like having your GPS tell you to turn left while the road signs point right. The Golden Cross might be strong enough to neutralize some of the bearish momentum, but it's going to need some help from buyers to really make a difference.

XLM Money Flow Shows Cracks in the Foundation

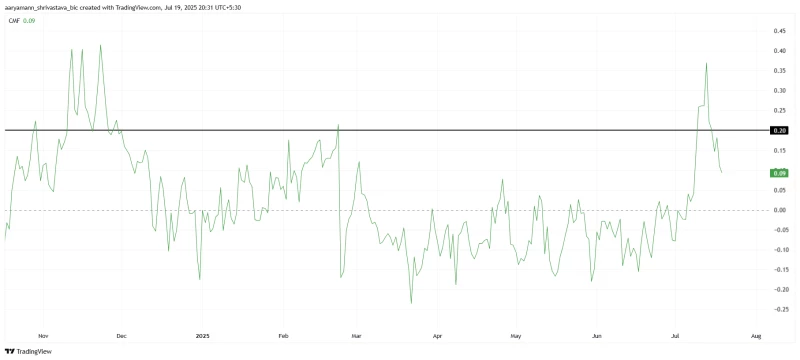

The Chaikin Money Flow (CMF) indicator is telling a pretty clear story here, and it's not entirely reassuring. Last week, this thing hit an eight-month high – basically showing that money was flooding into XLM like crazy. That was the fuel behind the rally we saw earlier.

But here's the kicker: the CMF has started rolling over. It's still above zero, which means more money is coming in than going out, but the trend is clearly weakening. Think of it like a leaky bucket – you're still adding water, but not as fast as before.

If the CMF drops below that zero line, game over. That would mean more money is leaving XLM than entering, and historically, that's not a good look for any cryptocurrency. We'd likely see additional selling pressure that could confirm the bearish case.

XLM Price Outlook: Make or Break Time

So what's next for Stellar? Currently sitting at $0.45, XLM is in a pretty precarious spot. If the selling continues and those outflows start dominating, we could see the price slip below key support levels at $0.43 and $0.41.

A break below those levels would open the door to $0.35 – and trust me, nobody holding XLM wants to see that happen. That would represent a pretty nasty correction from current levels.

On the flip side, if buyers step back in and those inflows recover, XLM could make another run at $0.50. A clean break above that resistance would completely change the narrative and potentially send the altcoin toward $0.56.

The bottom line? Stellar is at a critical juncture. The next few trading sessions will likely determine whether we're looking at a temporary setback or the beginning of a deeper correction. Either way, XLM holders should buckle up – it's going to be a bumpy ride.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah