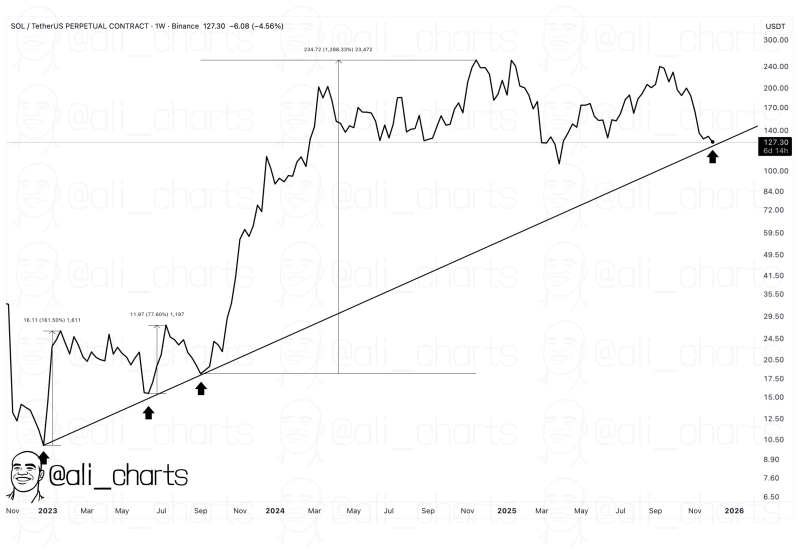

⬤ Solana has fallen more than 4 % this week and now sits close to a key price level. Market analysis shows that SOL is again touching a long term rising trendline that has served as a launchpad for rallies since early 2023. On Binance the perpetual contract lists SOL near $127, a price area where buyers have previously entered in large numbers.

⬤ This trendline has held through multiple market cycles. In early 2023 SOL rebounded sharply from this support moving from about $7 to $16. Several months later another test of the same line pushed prices from around $12 to nearly $24. On both occasions buyers acted with conviction at this structural level. The trendline later underpinned an even larger advance in late 2023 and 2024, when SOL surged from double digits to a peak above $230.

⬤ At present SOL is retreating from the upper part of its range and heading directly toward that same rising support. With the token just above $127 it is reaching the exact area where previous accumulation phases began. Since mid-2024 Solana has traded mainly between $140 and $240 and the latest decline returns price to a zone that has repeatedly drawn strong buying interest.

SOL is retesting a long term ascending trendline that has served as a major support zone since early 2023.

⬤ The market's next move at this support level will likely set the tone for broader momentum. Solana's price action often steers risk appetite across the altcoin space - whether this trendline holds or fails will shape expectations for near term volatility. With SOL now challenging a support level that has remained intact for almost two years, the coming trading sessions will show how sturdy sentiment is as the market enters its next phase.

Usman Salis

Usman Salis

Usman Salis

Usman Salis