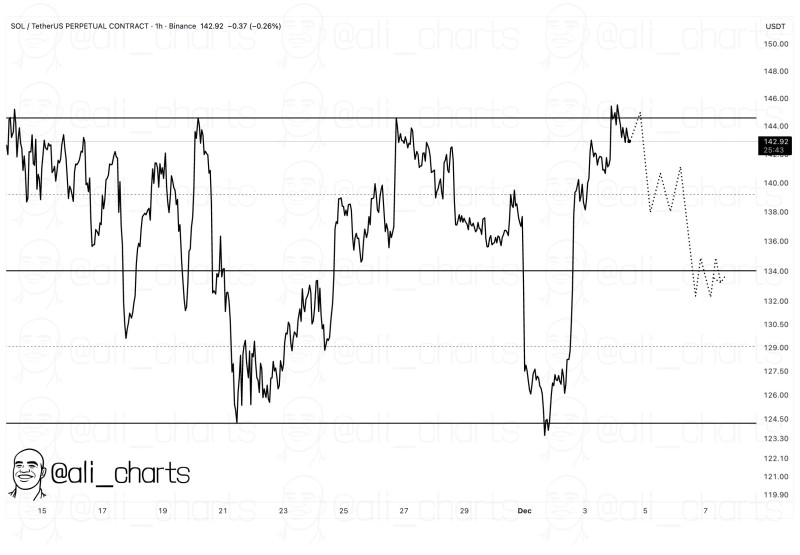

⬤ Solana is back at a crucial turning point, trading near the $144 mark that's consistently blocked further gains. This price zone has proven tough to crack, and while SOL has bounced back from last week's lows, it's struggling to push higher with any real conviction.

⬤ The chart tells a clear story: every time Solana approaches $144, sellers step in and push it back down. Projected scenarios show potential movement around $140 before sliding toward $135 if resistance holds firm. This lines up with concerns that failing to break above $144 could send SOL back down to test the $130 support area, a level that caught buyers' attention during recent market swings.

⬤ The rebound from around $126 shows there's decent buying interest at lower prices, but the repeated failures near $144 raise questions about how much strength is really behind this move. Multiple attempts to break higher have resulted in lower peaks, suggesting momentum is fading. Solana's been swinging wildly over the past two weeks, and right now it's all about what happens at this resistance level.

⬤ What happens at $144 matters. A clean break above would shift the mood and give bulls something to work with going forward. Another rejection, though, could trigger a pullback and open the door to $130. How traders respond here will shape Solana's next move and influence confidence across the ecosystem.

Usman Salis

Usman Salis

Usman Salis

Usman Salis