Solana (SOL) is showing signs of a potential rebound as major investors take advantage of the recent dip, accumulating large amounts of the token amid broader market weakness.

Whales Won't Stop Buying SOL Price Weakness

Here's what's really happening with Solana while everyone's freaking out about the price. Yeah, SOL got hammered 14% this week after hitting $206 back in July, and now we're sitting around $160. That's got retail traders sweating, but the whales? They're doing the complete opposite - loading up like there's no tomorrow.

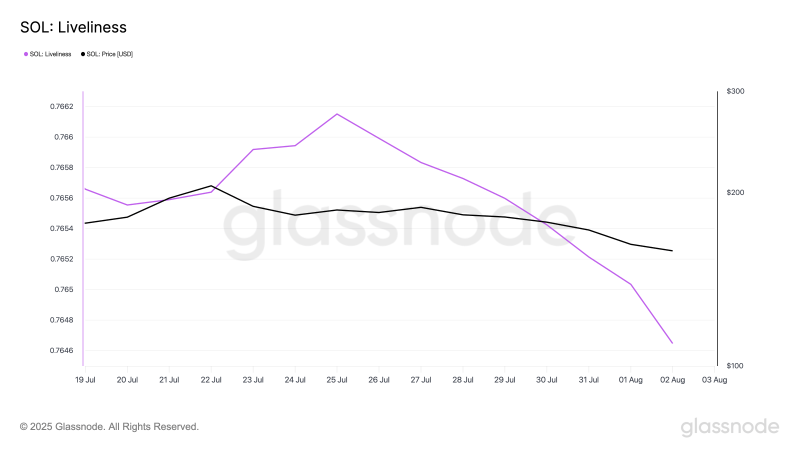

The data tells the whole story. Solana's Liveliness metric tanked to 0.76 yesterday, which basically means long-term holders aren't selling - they're keeping their bags locked up tight.

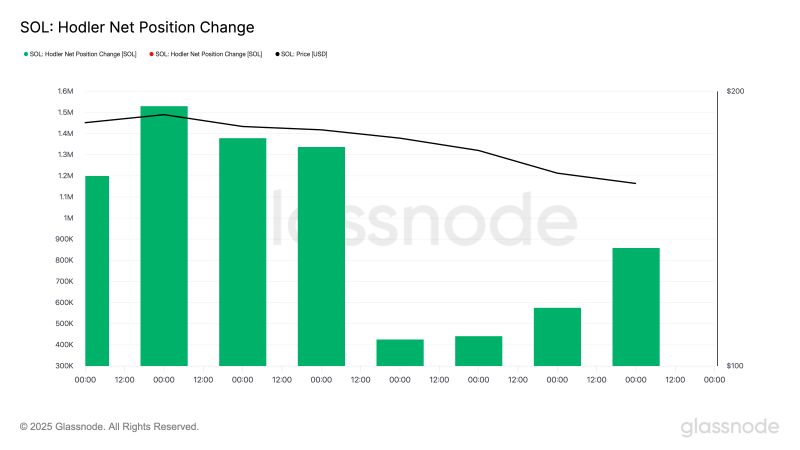

Even better, the Hodler Net Position Change spiked 102% over just four days since July 30. That's not retail behavior, folks. That's serious money making serious moves while the price gets beaten down.

Solana Price Shows Classic Bottom Formation

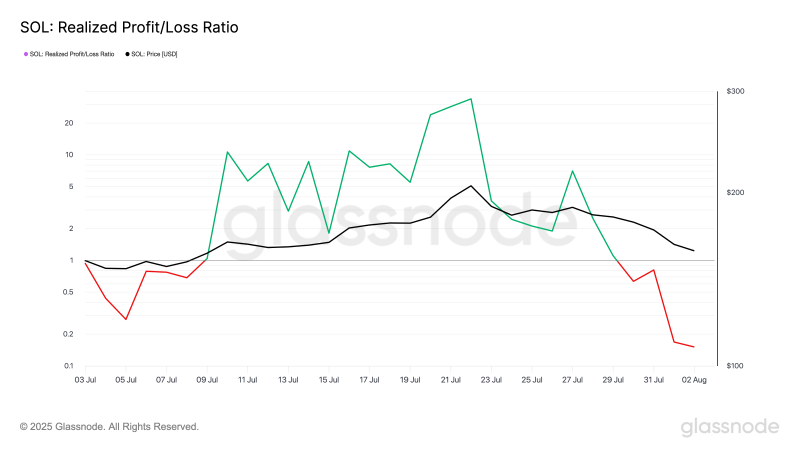

Here's the kicker - most people selling SOL right now are getting absolutely rekt. The Realized Profit/Loss Ratio hit a 30-day low of 0.15 on August 2, meaning for every dollar of profit, traders are booking about $6.67 in losses. Sounds terrible, right? Actually, it's bullish as hell.

When everyone's selling at a loss like this, it usually means we're close to the bottom. The weak hands are gone, selling pressure is drying up, and any good news could send this thing flying. It's like a compressed spring waiting to pop.

Critical Support at $158 Will Determine SOL Direction

Right now, SOL trades at $160.55, and everyone's watching that $158.80 support level. If it holds with all this whale accumulation happening, we could see a bounce to $176.33 - that's about 10% upside. But if it breaks, next stop is probably $145.90.

The bottom line? Smart money is accumulating, weak hands are out, and we're seeing classic bottom formation. SOL looks ready for a solid bounce once this selling pressure finally runs out of steam.

Usman Salis

Usman Salis

Usman Salis

Usman Salis