Solana (SOL) is showing signs of a potential breakout as bulls hold the $157 support level and set their sights on $185. The altcoin's technical setup suggests bullish momentum could be building.

SOL Forms Bullish Cup and Handle Pattern

Solana is currently testing its breakout zone around $157 after pushing above an ascending trendline this week. The price action lines up with the 1.618 Fibonacci extension near $178, showing bulls might be gearing up for another rally.

Right now, SOL is trading around $162.30, just under a key resistance level. This looks like a brief pause before the next move up. If the price stays above trendline support, we could see a push toward $185, especially if buying volume picks up.

SOL has formed a textbook cup and handle pattern on the daily chart. The cup hit bottom near $131, while the handle is consolidating just below the $166 neckline. This setup usually signals growing confidence and often leads to big breakouts once that neckline resistance gets broken.

If bulls can flip $166 into support, SOL could climb toward $185, with $220 as the extended target. The technical picture looks pretty solid for continued upward movement.

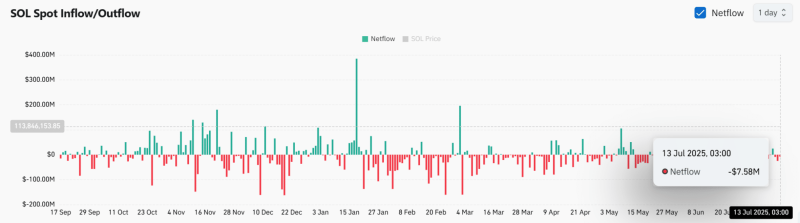

Exchange Outflows Show Growing SOL Confidence

Solana saw steady outflows on July 13th, with $7.58 million leaving exchanges. This pattern shows investors are pulling their SOL off exchanges, which reduces selling pressure in the market.

When tokens flow out of exchanges, it usually means people are planning to hold long-term rather than trade. This creates a supply squeeze that can push prices higher if demand stays strong.

The consistent outflow trend suggests accumulation is happening behind the scenes. With fewer tokens available for immediate selling, the setup favors continued upward pressure on SOL price.

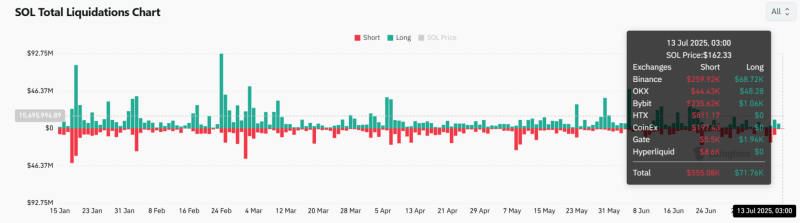

Short Liquidations Fuel SOL Rally

Solana saw a massive spike in short liquidations on July 13th - $555K compared to just $71K in long liquidations. This shows bearish traders got caught on the wrong side, likely pushing the price up as they scrambled to cover.

Most of these liquidations happened on Binance and Bybit, highlighting how many traders were betting against SOL. These squeeze events often act as fuel for price rallies, especially near important resistance levels.

If more bears keep getting forced out, SOL could gain extra momentum to break above that crucial $166 neckline. The liquidation data suggests sentiment is shifting from bearish to bullish.

Solana's technical setup looks promising, backed by the cup and handle pattern and solid trendline support. The combination of exchange outflows and short squeezes adds to the bullish case. However, breaking above $166 is still crucial for confirming the breakout. If buyers can turn this resistance into support, SOL could rally toward $185 and potentially $220. For now, the $157-$166 range remains the key zone to watch.

Peter Smith

Peter Smith

Peter Smith

Peter Smith