Solana has taken a beating this week, falling 15% from its $188 open and now testing the key $160 level. The selloff looks like it's being driven by Binance dumping tokens and traders getting squeezed out.

SOL Price Gets Hit in Broader Crypto Selloff

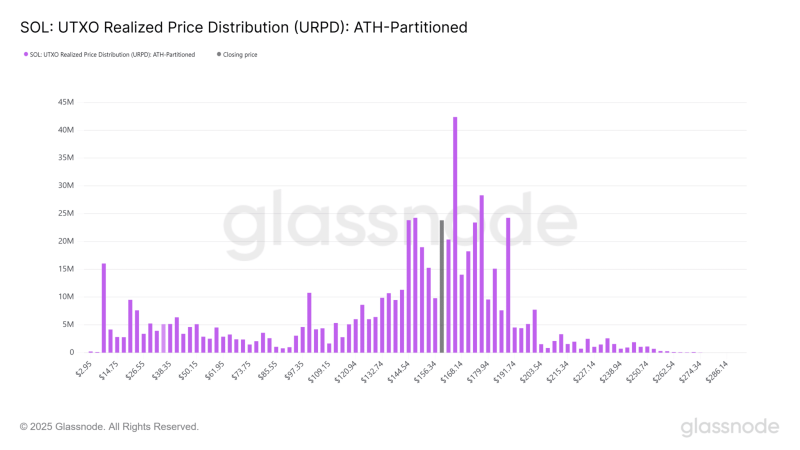

Crypto markets are ending the week deep in the red, wiping out nearly a month of gains. SOL has dropped below where most people bought in, meaning the average holder is now underwater.

Binance Dumps 110K SOL Tokens, Wipes Out Leveraged Traders

Binance just moved nearly 110,000 SOL to market maker Wintermute. When SOL was around $180, retail traders were 91% long, betting on a push to $200.

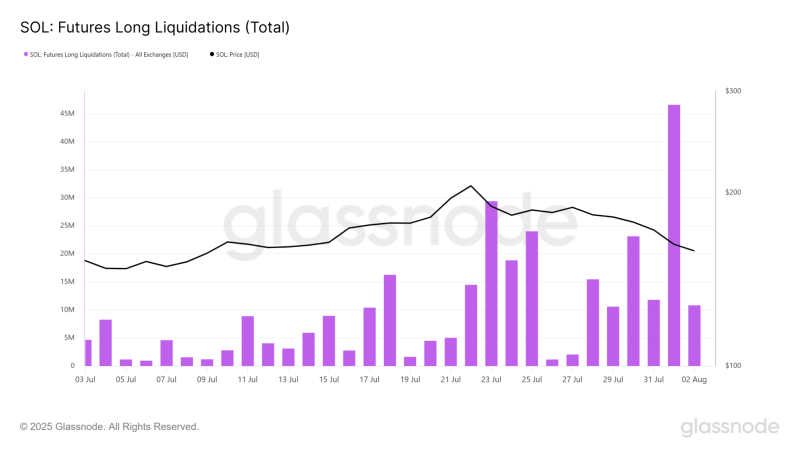

The market flipped, and long positions got crushed. On August 1st, Solana saw $46 million in long liquidations - the biggest wipeout since Q1. Even after this carnage, 78% of traders are still long on Binance.

SOL Price Could Fall to $140-$150 Zone

With $17.9 million in liquidations already cleared, this might just be round one. Looking at on-chain data, there's a big cluster of coins between $140-$150 where smart money could step in.

The technical picture isn't pretty: funding rates are long-heavy and realized losses keep climbing. Unless something changes fast, SOL price looks headed for that $140-$150 zone.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah