Solana (SOL) has bounced back impressively in recent weeks, riding the wave of renewed optimism across the crypto market. But if you look closer at what's happening beneath the surface, the picture isn't quite as rosy as the price chart suggests.

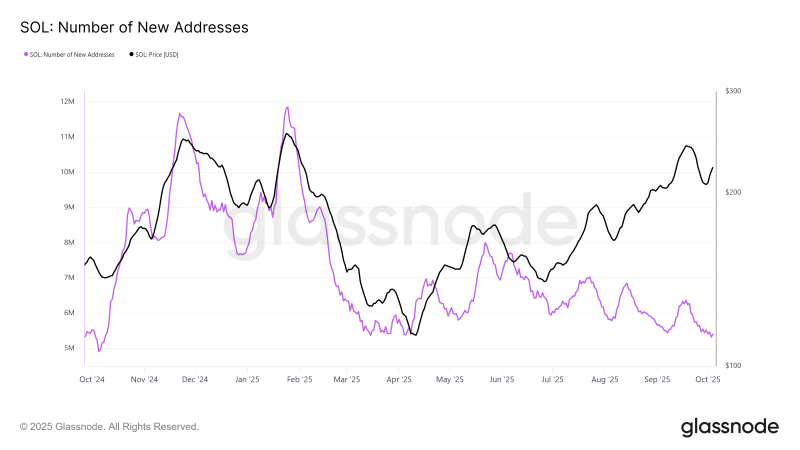

The real problem? Almost nobody new is showing up. The number of fresh addresses joining the Solana network has crashed to its lowest point in a year, which is a massive red flag for anyone watching this space. When a network can't attract new blood - whether that's retail traders or bigger institutional players - it's tough to keep a rally going, plain and simple.

Solana (SOL) On-Chain Metrics Flash Warning Signs

Right now, SOL is trading at $231, just shy of the $232 resistance that's been holding it back. Break through that, and $250 starts looking realistic. But here's the catch: without fresh capital flowing in, that breakout might never happen.

The Chaikin Money Flow indicator tells the same story. It's showing weak inflows from both new and existing investors, meaning the money that usually fuels these rallies just isn't there. When liquidity dries up like this, prices tend to stall out or even pull back - and that's exactly what Solana might be facing.

If SOL gets rejected at $232, we could easily see it slide back to $221, and that would pretty much confirm the bearish case. On the flip side, if sentiment shifts and confidence returns, pushing past $242 could put that $250 target back in play.

SOL Price Prediction: What Happens Next?

The next few days are crucial. Without stronger investor participation and better capital inflows, Solana's going to have a hard time holding onto these gains, let alone pushing higher. The fundamentals just aren't supporting the price action right now, and that's typically not a recipe for sustained rallies.

For traders watching SOL, keep an eye on volume, those CMF readings, and whether new addresses start picking up again. Those will tell you whether this rally has legs or if we're headed for consolidation - or worse.

Usman Salis

Usman Salis

Usman Salis

Usman Salis