Solana (SOL) three-month rally hit a snag recently, but here's the twist: while veteran holders are cashing out, newcomers are doubling down. This isn't your typical market dynamic, and it's creating some serious tension around where SOL goes next.

Long-Term Solana (SOL) Holders Are Quietly Exiting

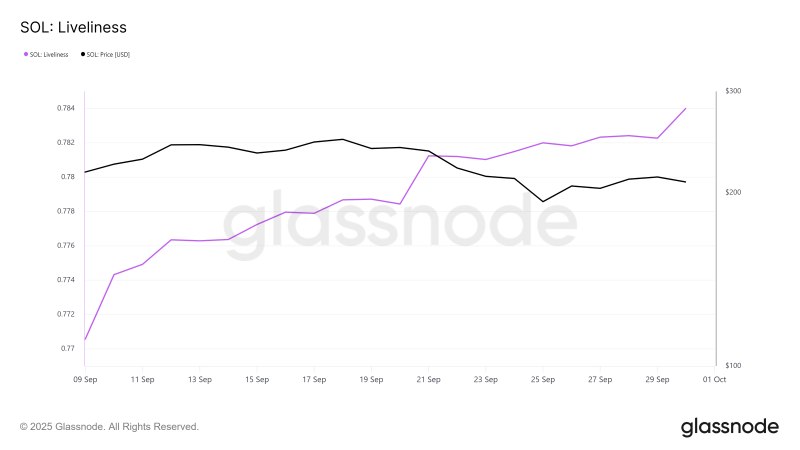

The on-chain data tells a clear story. Solana's Liveliness metric has spiked over recent weeks, showing coins that have been sitting dormant are suddenly moving. Long-term holders are offloading their positions, and they've been at it for about a month now. Sure, the selling has slowed down a bit, but it hasn't stopped.

When experienced investors who've weathered multiple cycles start heading for the exits, that's usually a warning sign. Their consistent selling likely contributed to SOL's recent dip and is putting continuous pressure on the price.

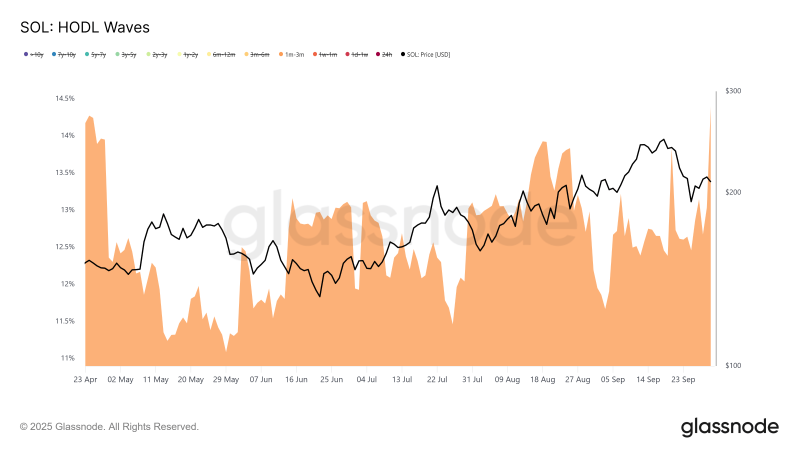

But here's what makes this situation interesting: newer investors aren't following the veterans out the door. HODL Waves data shows that short-term holders controlling coins for one to three months now make up 14.4% of supply - the highest in five months. These newer market participants are actually choosing to hold through the volatility instead of panic-selling.

This group has essentially become Solana's support system, offsetting the selling pressure from long-term holders. It's a classic standoff between the old guard taking profits and fresh blood betting on higher prices.

SOL Price Prediction: Will Bulls Push to $232 or Bears Drop It to $200?

Right now, Solana trades at $209, sitting just above the crucial $206 support level. The fact that it bounced back and is testing its uptrend line shows there's still commitment to keeping this rally alive.

If the bulls maintain control, SOL could push past resistance at $214 and $221. Breaking through those levels opens up a path to $232, which would validate the bullish outlook and probably bring more buyers into the market.

But if long-term holders ramp up their selling, things could get ugly fast. Dropping below $206 would be bad news, and a fall to $200 would basically kill the bullish narrative that's been driving the market for three months. That kind of breakdown would likely trigger more selling as traders who've been holding on finally give up.

The next few weeks are critical. Solana's caught between two forces pulling in opposite directions, and one of them is going to win. The question is: will the conviction of new holders be enough to push SOL toward $232, or will veteran investors' exits drag it down to $200? At $209, we're right in the middle of that battle, and the answer should reveal itself pretty soon.

Usman Salis

Usman Salis

Usman Salis

Usman Salis