Solana (SOL) had a rough couple of weeks. Every time it tries to break higher, the move fizzles out into a short-lived bounce. The token's down 10% over the past seven days, though it's still holding onto a small 2% gain over the past three months—keeping the broader uptrend alive, barely.

But this time might be different. Both on-chain data and chart patterns are aligning in a way that suggests the next bounce could actually stick. If SOL clears a few key resistance levels, what starts as a bounce could turn into a legitimate rally.

Short-Term Holders Are Accumulating While Long-Term Sellers Ease Up

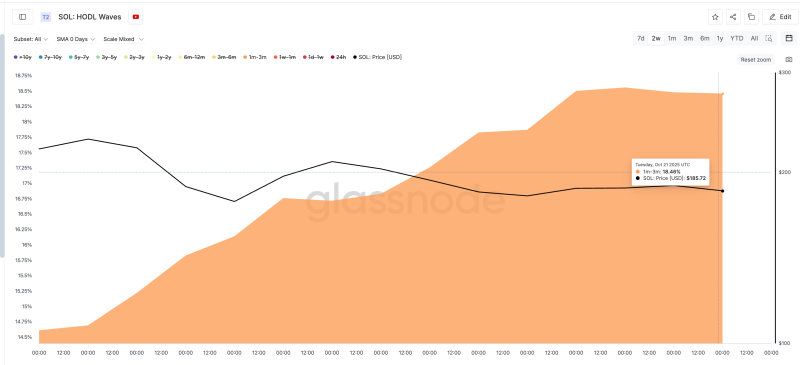

On-chain data from HODL Waves shows short-term holders are back to buying. Between October 7 and October 21, wallets holding SOL for one to three months increased their share from 14.61% to 18.46%—a roughly 26% jump. That's clear accumulation near recent lows.

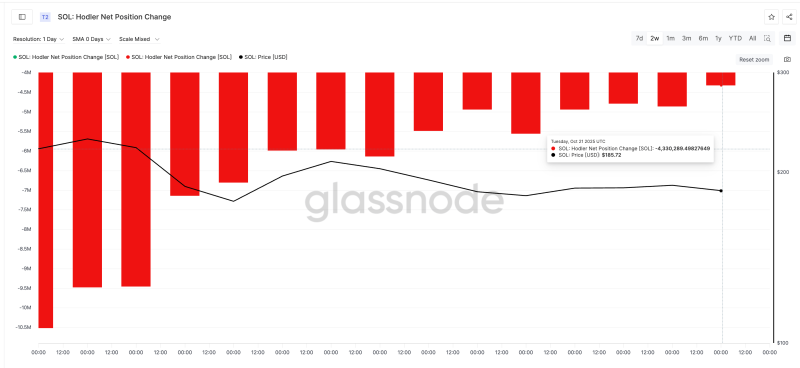

Meanwhile, long-term holders are still selling, but much slower now. The Hodler Net Position Change metric remains negative, but outflows have dropped sharply by about 59%, from -10.52 million SOL on October 7 to -4.33 million SOL on October 21.

Short-term buyers are absorbing almost everything long-term holders are offloading. Selling pressure is easing, and fresh money is coming in. This setup can fuel a stronger bounce. The real catalyst would be if net-selling flips to net-buying—that's when things get serious.

SOL Price Chart Points to Breakout Window Opening Soon

Technically, Solana's sitting inside a falling wedge pattern—a setup that usually resolves upward. The Relative Strength Index (RSI) is showing a bullish divergence. Between September 25 and October 21, RSI made higher lows while price made lower lows.

This typically signals a trend reversal, though SOL has been settling for small bounces. A similar pattern between September 25 and October 17 triggered a 13.4% rebound, pushing Solana from $174 to $197.

If the same thing happens now, a 15% move from the current $184 level would take Solana to $213, breaking its pattern of lower highs. A further 20% push to $222 would confirm a wedge breakout and could extend the rally toward $236–$253.

But if Solana drops below $172, the bullish structure breaks down and could trigger a deeper slide. Bulls need to watch that level closely—it's the line in the sand.

For now, improving momentum and easing sell pressure suggest this bounce might finally have enough strength to spark a real rally.

Peter Smith

Peter Smith

Peter Smith

Peter Smith