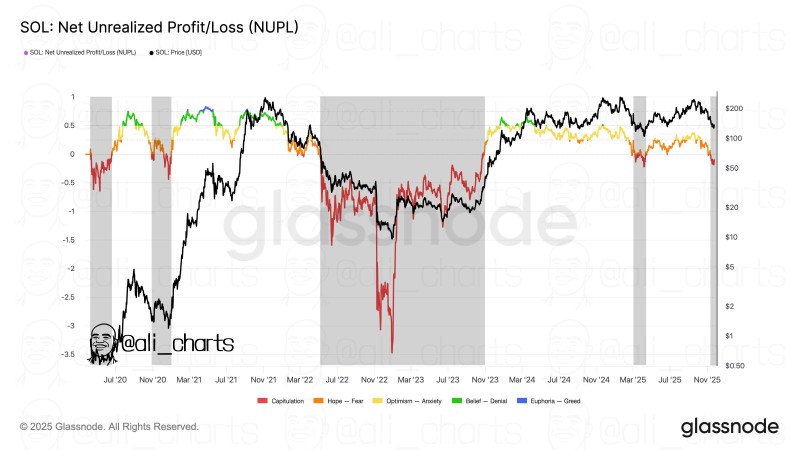

⬤ Solana's hitting a critical psychological turning point as its Net Unrealized Profit/Loss metric signals deep capitulation. The latest NUPL readings show SOL might be forming another market bottom—something that's happened consistently during past investor capitulation phases. Right now, Solana's price is sliding lower while NUPL dips into the red zone, showing widespread unrealized losses across the network.

⬤ NUPL tracks investor sentiment by comparing unrealized profits and losses against price movements. Looking at past cycles, SOL's biggest bottoms formed when NUPL dropped into capitulation territory—those extended red regions on the chart. These zones line up almost perfectly with previous major trend reversals. The current two-week stretch of negative NUPL readings looks a lot like similar periods from late 2020, mid-2022, and early 2023—each of which came right before significant rallies. The chart captures the full emotional journey of market participants, from optimism through anxiety and ultimately into fear and capitulation.

⬤ Solana's pulled back hard from recent highs near the 180–200 range, dropping toward lower support levels. While the price is still elevated compared to deep historical lows, the current NUPL drop suggests holders are having a disproportionate psychological response—something you typically see during late-cycle corrections. The shaded areas on the chart highlight these cyclical phases, showing where capitulation historically overlapped with price stabilization and the rallies that followed.

⬤ Sentiment-driven metrics like NUPL often serve as early warning signs that prolonged downturns are running out of steam. When capitulation lasts for multiple weeks, it can set up conditions for a broader market shift and help prices form a stronger foundation. If Solana holds its current structure and selling pressure starts to ease, this capitulation phase could mark the start of a new recovery cycle—just like we've seen in previous years.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah