Solana just hit a sweet spot that traders dream about. The charts are showing something interesting - barely any resistance ahead while sitting on bulletproof support levels. It's the kind of technical setup that can lead to explosive moves, and @ali_charts is already flagging it as one to watch closely.

Chart Breakdown: Where the Smart Money Accumulated

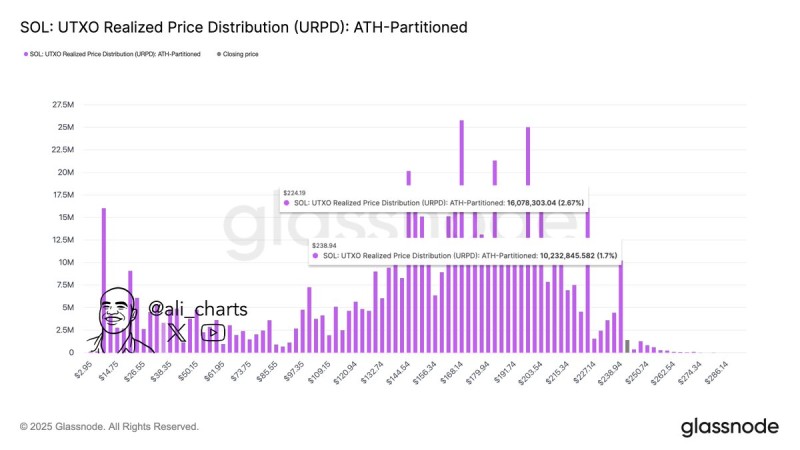

Ali is already flagging the UTXO Realized Price Distribution tells the real story here. Heavy accumulation happened around $224 and $239, and those zones are now acting like concrete floors. When you see this kind of clustering in on-chain data, it usually means one thing - institutional players and smart money parked their cash at these levels and aren't planning to sell anytime soon.

What makes this even more compelling is the thin air above these support zones. There's practically nothing standing in the way if bulls decide to push higher. In crypto, that's often all you need for a serious run-up.

The Bullish Case Gets Stronger

Solana isn't just riding on technicals. The fundamentals are backing up the charts in a big way. DeFi activity is picking up steam, NFT volumes are staying healthy, and developers keep choosing Solana for new projects. All that translates to real demand for SOL tokens, not just speculation.

The combination of strong on-chain activity and favorable chart structure creates what traders call a "high-probability setup." When fundamentals and technicals align like this, the market usually takes notice.

Here's the simple playbook: as long as SOL holds above $224 and $239, the path of least resistance points up. Those support levels give traders clear lines in the sand for risk management, while the lack of overhead resistance means any buying pressure could send prices significantly higher.

A breakdown below these supports would change everything, but right now the momentum and structure favor the bulls. Solana's positioned for another leg up if the current buying interest sticks around, making it one of the most interesting altcoin setups heading into the next phase of the market cycle.

Peter Smith

Peter Smith

Peter Smith

Peter Smith