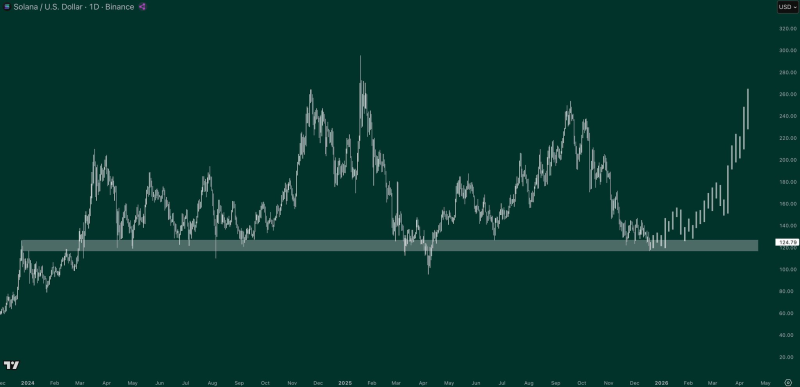

⬤ Solana (SOL) is bouncing back strongly after holding firm at a key $120 support zone, showing clear signs of renewed momentum on the daily chart. The move wasn't random—it represents a strategic positioning play based on expectations that broader upside is coming. After months of sideways trading, SOL has decisively bounced from this level and is now pushing higher with real conviction.

⬤ The $120 area has proven itself as a reliable demand zone across multiple market cycles. Every time price has tested this region before, buyers stepped in aggressively and pushed it back up. This latest bounce follows the exact same playbook. After briefly dipping into support, Solana quickly reclaimed higher ground and is now climbing sharply toward the $200–$260 range, showing that buyers are back in control after a long period of choppy, indecisive action.

The move was not accidental—this was a deliberate long positioning strategy based on expectations of a broader upside move.

⬤ Looking at the bigger picture, Solana has a clear pattern: long accumulation phases followed by explosive rallies. The current breakout looks almost identical to those previous setups. The clean hold above support combined with accelerating price action suggests growing market confidence. As long as SOL stays above that former $120 support band, the structure favors more upside, even though volatility remains high.

⬤ This matters beyond just Solana itself. SOL often acts as a high-beta gauge for risk appetite in crypto—when it moves, it tends to signal broader market shifts. If this momentum holds, it could spark renewed interest across altcoins and pull more capital into high-growth blockchain projects. Solana's price action over the next few weeks might set the tone for the wider market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah