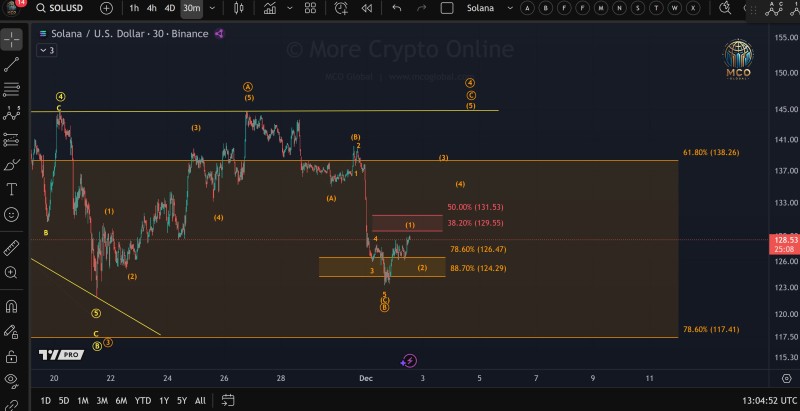

⬤ Solana is showing signs of stabilization after its recent pullback, with price action from yesterday's low forming the first well-defined 5-wave structure seen in several sessions. The move suggests traders are attempting to build a reversal, though it's still too early to call it confirmed. Strong buying emerged from the $124-$126 zone, an area that lines up with deeper Fibonacci levels and provided temporary floor support. SOL is currently hovering around $128, inching toward resistance levels that will likely decide whether this bounce has legs or fades back into consolidation.

⬤ The chart reveals an impulsive 5-wave rally labeled as wave (1), followed by a relatively shallow correction into the 78.6% Fibonacci zone before buyers returned. Despite this encouraging structure, Solana hasn't yet cleared any major resistance. The red zone between $129.55 and $131.53 marks the immediate challenge, with $131.50 standing out as the critical line in the sand.

⬤ Higher Fibonacci targets like $138.26—the 61.8% retracement of the prior decline—won't come into play unless SOL can push past near-term resistance first. For now, this recovery is best described as preliminary. The emerging 5-wave sequence is a positive development, but it's not enough on its own to confirm a trend shift. The market needs to show real follow-through beyond the initial reaction zone before traders can confidently assume the correction is over.

⬤ Solana sits at a technical crossroads where a confirmed breakout could flip momentum toward a broader recovery phase. Clearing $131.50 would signal growing confidence and potentially trigger higher-timeframe continuation patterns. On the flip side, failing to hold above recent support levels could trap SOL in a deeper corrective cycle and delay any meaningful uptrend. The next few sessions will reveal whether this impulsive structure evolves into something sustainable or just turns out to be another short-term bounce inside a larger consolidation range.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah