Shiba Inu (SHIB) is making headlines for all the wrong reasons. The popular dog-themed cryptocurrency just experienced a jaw-dropping 97% drop in large holder inflows over three days, and it's got the community talking.

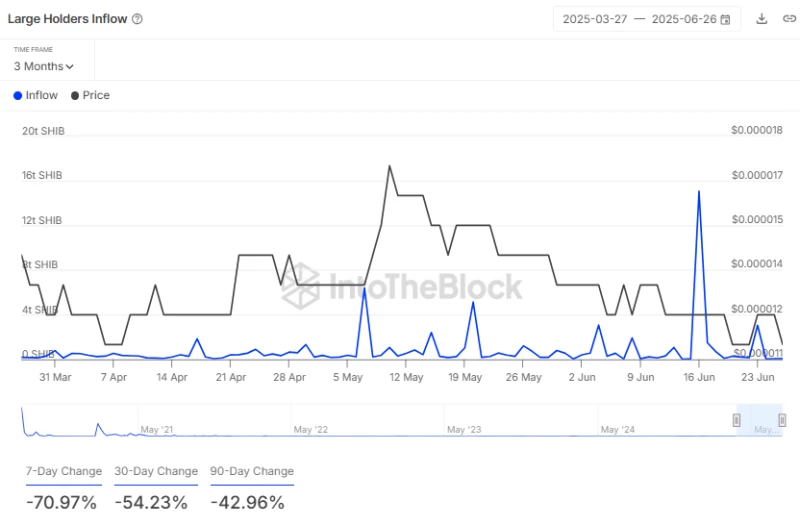

Here's what happened: IntoTheBlock data shows SHIB's large holder inflows crashed from 3.06 trillion tokens on June 23 to just 84.76 billion on June 26. That's not just a dip – it's whales practically disappearing from the scene.

Why SHIB (Shiba Inu) Whales Are Sitting This One Out

When we talk about large holder inflows, we're looking at money flowing into whale wallets – the big players who can really move markets. A 97% drop? That's whales hitting the brakes hard.

This pullback suggests big investors are playing it safe right now. Maybe they're waiting for better prices, or maybe they just want to see where the market's heading before diving back in. Either way, when whales step back, it usually means less buying pressure for SHIB.

The timing isn't random either. Crypto markets have been pretty volatile lately, and smart money often sits on the sidelines when things get choppy. These big holders might be waiting for clearer signals before making their next move.

Shiba Inu (SHIB) Price Gets Hit by Profit-Taking

SHIB had a decent run recently, hitting $0.00001192 on June 24 during a two-day rally. But good things don't always last in crypto. Profit-takers jumped in after that peak, and now SHIB is trading down 0.75% at $0.00001115.

The broader crypto market isn't helping either. Everything's in the red after some disappointing inflation news came out. When macro conditions get shaky, meme coins like SHIB often feel it first.

Inflation Numbers Spell Trouble for Risk Assets

Here's the bigger picture that's affecting SHIB and crypto in general. The Commerce Department dropped some inflation data on Friday that nobody wanted to see. The Fed's favorite inflation measure jumped 0.1% for the month, pushing the annual rate to 2.3%.

That might not sound like much, but it's moving away from the Fed's 2% target – something they haven't hit since early 2021. Core inflation was even worse, jumping to 2.7% in May when everyone expected less.

Why does this matter for SHIB? Simple. Higher inflation means the Fed's less likely to cut interest rates, and rate cuts usually help risky assets like crypto. The Fed's probably keeping rates unchanged at their July meeting, which means less cheap money flowing into speculative investments.

For SHIB holders, this creates a perfect storm: whales backing off, profit-takers selling, and macro headwinds all hitting at once. It's no wonder the token's struggling right now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis