Shiba Inu (SHIB) just bounced off crucial support after dropping nearly 10% this week. The meme coin still holds a 7% monthly gain, but traders are wondering if SHIB can keep momentum through August.

SHIB slipped almost 10% over seven days but remains up 7% for the month. With crypto markets volatile, everyone's asking: will SHIB keep climbing or is it running out of gas? Several behind-the-scenes indicators suggest things might not be as bad as they look.

SHIB (Shiba Inu) Exchange Reserves Stay Near Yearly Lows

SHIB's exchange reserves are sitting near yearly lows, suggesting minimal selling pressure. The reserves hit a 12-month low of 895.9 billion SHIB on June 22. As of August 5, they've crept up to 1.04 trillion - still way below the yearly average.

Low exchange reserves usually mean people aren't rushing to sell, or big players are absorbing selling pressure. Both scenarios are bullish for SHIB price.

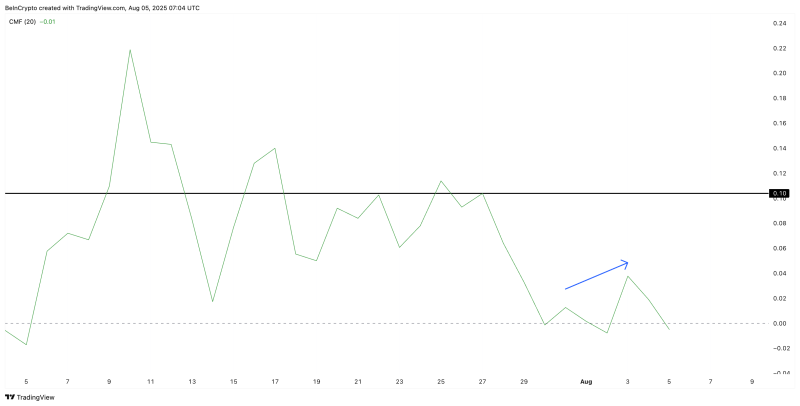

SHIB Price Shows Hidden Buying Despite Weakness

The Chaikin Money Flow (CMF) is showing a bullish divergence. On July 31, CMF peaked, then by August 3, it hit a new higher peak even though SHIB price made a lower low.This divergence suggests hidden accumulation - stronger buying interest happening behind the scenes despite weak price action.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's Daily Crypto Newsletter here.

Key SHIB (Shiba Inu) Price Levels to Watch

SHIB bounced off the lower trendline of an ascending triangle, keeping the bullish structure alive. But resistance levels are stacked up ahead.

SHIB is stuck below 0.0001258, with more resistance at 0.0001318 and 0.0001368. Breaking through opens the path to 0.0001599 - the key breakout level that would confirm a higher high.

The flip side? Breaking below the triangle's lower trendline around 0.0001160 would kill the bullish setup. SHIB is showing fight by holding support and displaying hidden accumulation, but it needs to crack these resistance levels for a real breakout.

Usman Salis

Usman Salis

Usman Salis

Usman Salis