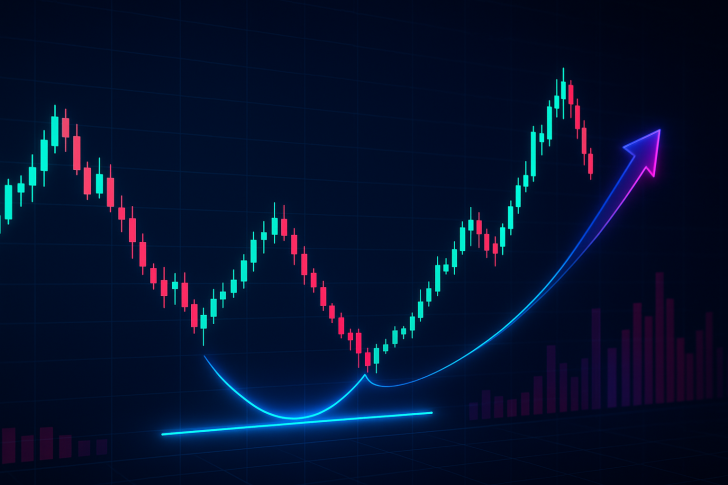

⬤ SEI is testing crucial support after a prolonged downward move, with price now hovering near $0.13. The token needs a strong reaction at this zone to validate a potential double-bottom formation. Buying pressure at this level has historically triggered notable reversals, making the current structure a key focus point.

⬤ The chart shows two rounded lows forming across multi-month price action, suggesting SEI may be attempting a bullish reversal pattern. The upper boundary near $0.34 remains the neckline for any breakout scenario, while the projected recovery path shows possible upside if the pattern confirms. Holding this support area is essential, as losing it would invalidate the double-bottom setup.

⬤ Market momentum has been weak recently, but previous reactions from similar rounded-bottom areas show SEI's tendency to stage sharp recoveries once a base is secured. The projected recovery suggests a gradual climb could begin if buyers step in, with early targets around $0.17 to $0.25 before approaching the broader $0.34 resistance zone.

⬤ This setup matters because SEI's ability to hold this support may influence broader market sentiment and shape near-term price behavior. A confirmed double bottom could shift momentum upward, while a breakdown would extend the downtrend and signal deeper market weakness.

Peter Smith

Peter Smith

Peter Smith

Peter Smith